Harness the Power of Benchmarking for Your Farm’s Growth

Benchmarking is the process of comparing your operation’s financial ratios against those of similar operations. It can be a powerful management tool for evaluating your farm’s performance. When done correctly, benchmarking can provide you with a clear picture of where your operation needs to focus efforts to achieve your financial goals. It can help you make decisions to improve your operation’s performance and capitalize on your strengths.

What is Benchmarking and Why Should You Use It?

Before comparing your operation to others, you need to start with quality financial data. Here are the key pieces of data you’ll need:

- Accurate year-end balance sheet

- Accrual-adjusted earnings statement

- Annual tracking of scope and production

- Recorded family living expenses

To perform financial benchmarking, you need to consistently complete an accurate year-end balance sheet every year. This will enable you to adjust your earnings for accruals, considering changes in grain inventories and values, livestock inventories, pre-pays and accrued expenses at year-end. Accurate scope and production information will be required to quantify your operation each year. Additionally, it’s important to record your family living expenses on an annual basis. This allows for you to understand the funds required to support yourself and your family. (e.g., groceries, family vacations, everyday expenses).

Data-driven Insights: Analyzing Strengths and Areas for Improvement

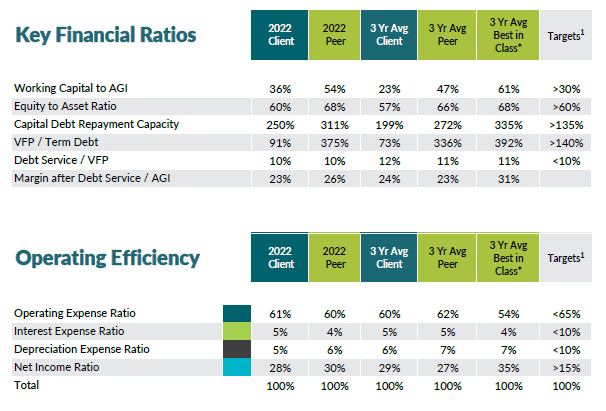

Now that you have your data, it’s time to compare it to your peers. Are there areas where you excel? Are their areas that you can improve compared to your peers? Here are a few key targets to focus on:

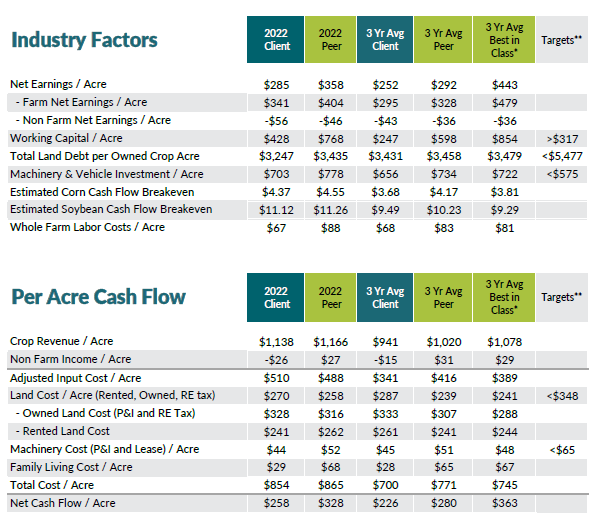

Land Debt/Acre: This ratio will vary depending on your operation’s stage. It’s important to maintain a manageable debt level relative to the numbers of acres you own. Cash rented acres can help support debt payments on owned acres, but too much debt can create long-term sustainability challenges.

Machinery Investment/Acre: Machinery is typically an operation’s second-largest capital investment after land. Managing your investment in machinery on a per acre basis is crucial. However, diversified operations that require specialized or livestock equipment may have figures exceeding target ranges.

Machinery Cost (Equipment Principal & Interest payments)/Acre: Similar to land debt per acre, it’s important to keep your machinery payments per acre at a manageable level for your operation.

Working Capital/Acre: Working capital is calculated as your current assets minus your current liabilities. It’s important to keep enough cash reserves to operate. Utilizing cash (working capital) helps keep interest expense low, take advantage of input cost savings and weather less profitable years.

Operating Expense Ratio: The operating expense ratio shows how much of your revenue goes toward operating expenses. Operations that farm a majority of rented acres will have a higher operating expense ratio due to cash rent expenses. A lower operating expense ratio leads to higher profitability and net income ratio.

Debt Service/VFP: It’s critical to align your debt levels with your revenue-generating capacity. Mismatched debt levels can pose risks to a farming operation.

Setting a Path to Prosperity: Establishing Realistic Goals

Every operation is in a different position with different aspirations and goals. After you understand how you compare to your peers, you can set realistic goals on how to capitalize on your strengths and improve areas that need attention. Benchmarking allows you to evaluate your operation’s performance and track your progress each year. Remember to allow ample time to reach your goals, as industry factors may affect the speed of progress. Short and long-term goals are important, and they may differ from your peers’ goals based on personal aspirations.

Compeer can help you with benchmarking your operation. Talk to your local financial officer about Compeer’s Financial Peer Report where we can help use your operation’s data to identify competitive advantages, areas for improvement and establish your financial goals.