Tillable Land Value & Trends

With the growing season at hand, farmers across the area are hustling to maintain their fields. Here in southeastern Minnesota, specifically Winona, Houston and Fillmore Counties, there has been a lot to think about. Volatile commodity prices, hedging strategies, fertilizer and other input costs, and the outlook for land values are just a few. The fall of 2021 had some of the highest land sales for this area in a long time.

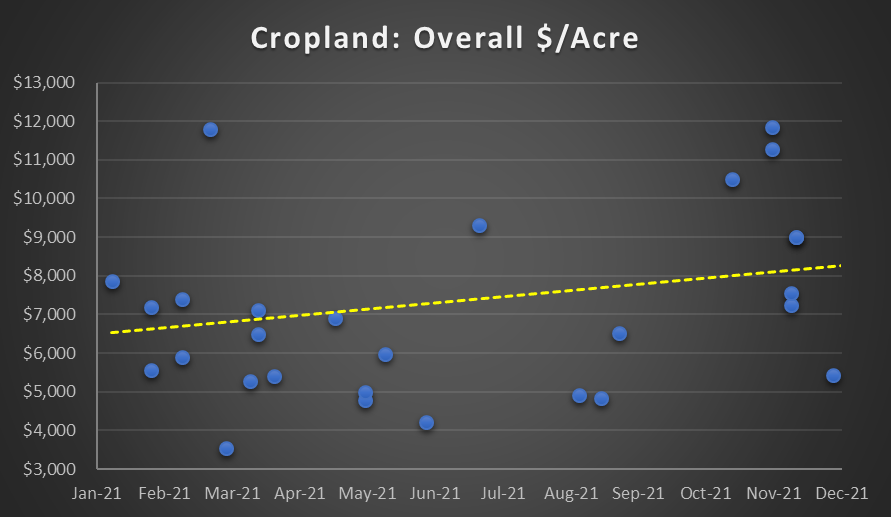

At the beginning of 2021, values for most of the tillable acreage was in the $5,000/acre to $7,500/acre range. It was the post-harvest sales that really told a story of where values are heading. Take note in the graph below of where the spring auctions and listings were …and then after October.

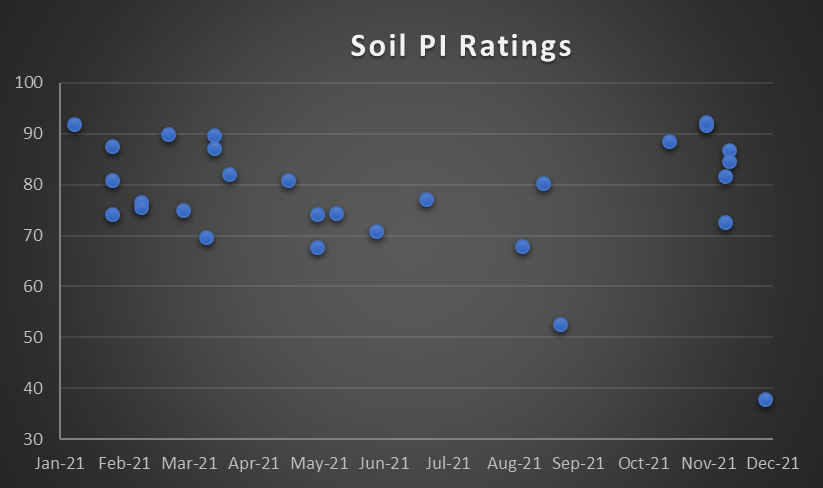

You got it. Tillable land has definitely appreciated in value. You may be wondering about the one low sale at the end of the year, but I’ll get to that soon. A tool that appraisers at Compeer commonly use when appraising cropland is one that links the value of a property to its productivity by taking the allocated $/Tillable Acre and dividing it by the soil’s productivity index (PI) rating. The productivity index is a rating system used in Minnesota that rates the productivity of the soil on a 0 to 100 basis with 100 being the most productive soil in the state. Most tillable acres in this area are in the range of 70 to 90 PI as can be seen below from all of the advertised cropland sales of 2021:

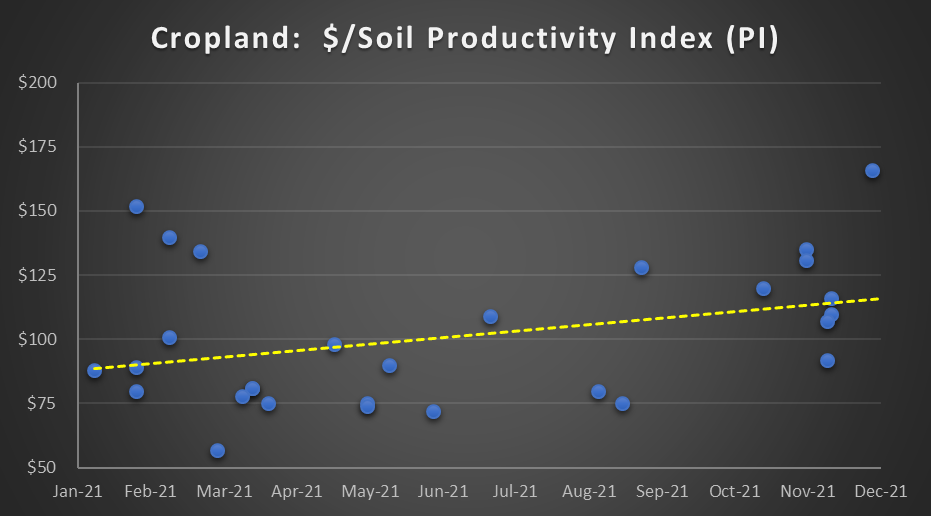

See that last one way on the right? That’s the low sale from December 2021. Now when the sales are analyzed on a $/PI basis, this graph gives a more consistent analysis and another indication that the market values have increased.

That low sale in December has the highest $/PI value from the year, meaning that even though it had a low overall price, the buyers paid a high value when considering the amount of bushels/acre the ground could produce. The important thing to note from this graph is that the people purchasing these properties are still considering the productivity of the soil when making these purchasing decisions due to the relative consistency in the trend. Another thing to note is that $/PI values in the spring were $75/PI to $90/PI. When looking at the post-harvest auctions, $/PI values are over $100/PI. This means that tillable acres with a PI rating of 70 (which is some of the lower quality ground for this area) could be worth $7,000/acre. You can bet that rental rates have acted similarly to these values too.

Overall, people in the market feel skeptical, which is understandable with values where they are. Regardless, these sales are closing and it could be due to a multitude of reasons for why someone is willing to pay the higher price. As 2022 continues on, it seems that everyone is holding their breath to see if this is the…“new normal.”

If you're interesting in finding an appraiser in your area, check out our Appraisal Services page on our website. You'll find articles from our appraisal team, an interactive map to find an appraiser in your area and other information.

NOTE: The sales analyzed for this article are from the Appraisal Departments database at Compeer Financial. All of the sales are analyzed by Certified General Appraisers. The sales are located in Winona, Fillmore, and Houston Counties and are over 20 acres. All of the sales were publicly marketed properties. Other sales did occur in the area, but for the purpose of this article, only the ones that received adequate market exposure were considered and were over 20 acres. Hope you all have a great growing season!