Navigating Interest Rate Shifts: Impact on Land Values and Farm Profitability

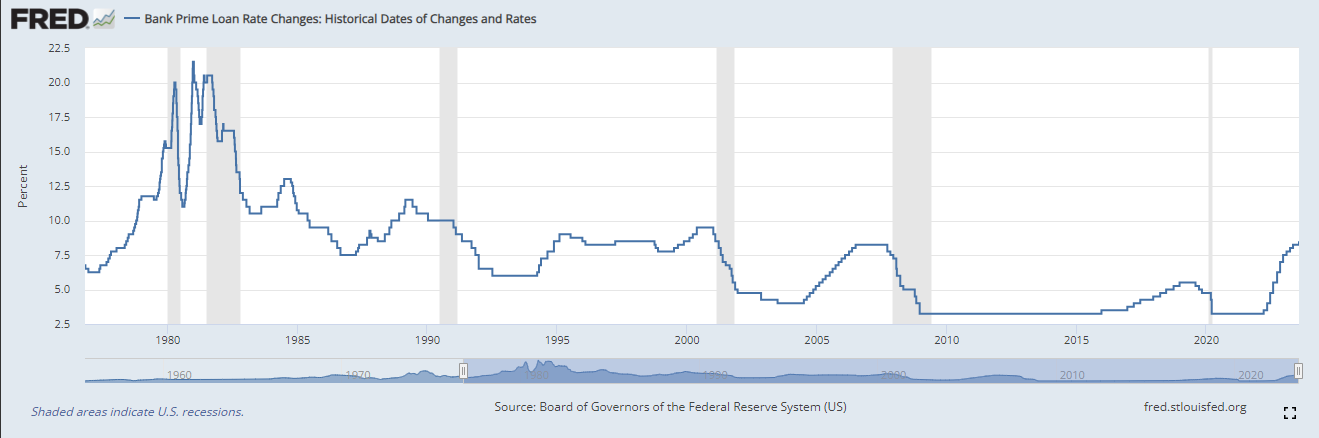

Today, much of the agriculture industry’s focus centers on the intricate relationship between increasing interest rates, land values and farm profitability. At first glance, this task may seem daunting, but let’s unravel these threads together. As I write this, the U.S. Bank Prime rate sits at 8.5%, marking a significant change. Reflecting on my journey in this business since 2007, I recall the Prime Rate primarily residing below 4% during my tenure at Compeer Financial. Yet, delving into historical interest rates, our current rates, while not unprecedented, stand out due to their speed of change. These present rates mirror those observed before the housing market recession of 2008, and the tech bubble of 2000.

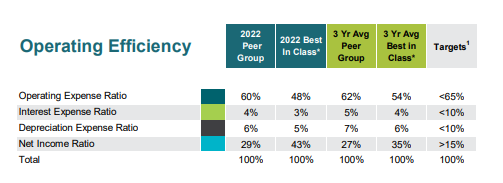

Considering the impact of interest on farm profitability I looked through the Compeer 2022 Grain Farm benchmark data. In that year, the farms in our Grain Benchmark showcased an interest expense ratio of 4% of farm production. This figure contrasts with the industry’s target and best practice of maintaining this ratio below 10%. Here in Northern Illinois, we’ve enjoyed the benefit of two prosperous years, bolstering farmer working capital and reducing borrowing needs. A glance at a snippet of our grain benchmark data serves to illustrate this point.

Drawing from this data and other pertinent sources, I believe most grain farms find themselves positioned well to weather the effects of the escalating interest rate landscape. That being said, it’s important to acknowledge that interest cost directly chip away at net income, and the shift is swift. Managing interest expense is going to be important in any business going forward, especially in one as capital-intensive as grain farming. Farmers ought to exercise caution when considering new debt, given the prevailing interest levels. Managing interest rates is likely to become more important than it has been in recent years.

In spite of these challenges, I believe our industry approaches this new landscape with a foundational financial strength. I remain confident that American agriculture will adapt to this evolving scenario, as it has time and again.

Check out other grain articles and resources on Compeer.com.