Swine Industry Faces Challenging Times: A Lender's Perspective

The swine industry’s future was once filled with optimism, expecting a turnaround that would bring back profitable times. However, the first six months of 2023 proved to be the most arduous period in the careers of many, including my own. During the initial three months, losses averaged over $22 per head, while working capital eroded to $200 per sow equivalent on farms. Despite owner’s equity holding at an average of 54%, concerns among producers have been exacerbated by the deepest losses experienced in recent history, particularly April and May which hasn’t been calculated into our database yet and will further erode working capital.

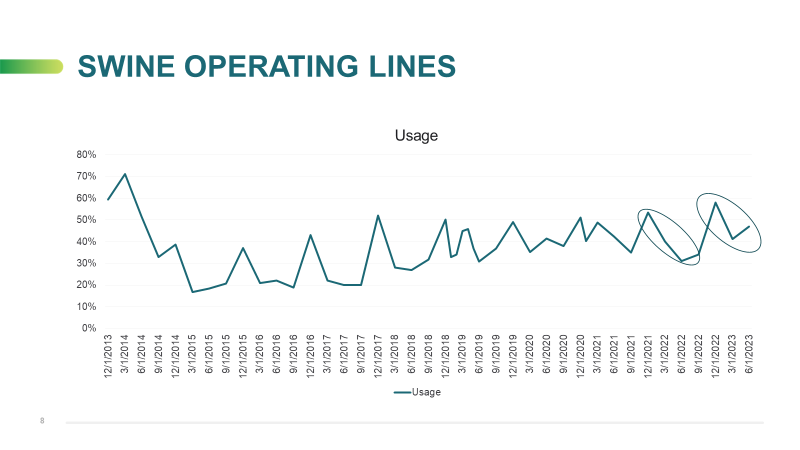

As a lender, the most reliable data we have is based on our advance rates for clients’ operating lines. Currently, our advance rates are approaching 50% used, prompting and extremely busy time for our swine lending team. Usually, we record our lowest advance rate this time of year, with peaks anticipated at year-end due to deferred income and prepaid expenses for tax planning. I fully expect that our peak borrowing by the end of this year to surpass the 60% to 65% mark, although falling short of the peak needs observed 2014, which were driven by margin calls that year.

While the data we review represent averages, it is important to recognize that not all farms fall into this category. The Compeer database shows a normal bell curve distribution of operations, indicating that while some face severe stress, others may question their long-term involvement in the industry. Individuals must ponder whether they are solely driven by profits or if they genuinely have a passion for building a business that benefits their family, employees and community. Deciding to change one’s livelihood significantly impacts not only immediate family but also vested partners, including employees, growers and local community that relies on the business for products and services.

The burden of such a difficult decision is considerable. My strong recommendation is to not carry that burden alone. Industry professionals, trusted advisors and counseling can be valuable resources to navigate through these challenging times.

Although there may be hope for improvement in the future, it looks like a turnaround may be a few quarters away. To manage the situation effectively, I recommend you run a burn rate analysis on your operation and update it monthly. This analysis will provide insights into the rate at which working capital is depleting and, more importantly, whether the business can maintain its cash flow. Run projections through calendar year 2024, including any financial covenant testing that you can share with your lender. While lenders understand the cyclical nature of the pork industry, they also appreciate transparency and don’t like surprises. Currently, the industry’s return to profitability seems possible during the second quarter of 2024, but it is crucial for operator to offer as much transparency and insight into their operations as possible to achieve this goal.

For more insights from Steve and the Swine Team, visit Compeer.com