Are High Building Costs Impacting Appraised Dairy Facility Values?

This question is on the minds of many dairy producers. When trying to make big decisions on whether to build a free stall barn, heifer shed, new parlor, or that new robot barn; the underlying factor is what it will be worth once it is erected and operational. Sales of dairy properties are rare in general. It’s even more unique to find sales that include new improvements. Given the lack of sales with new facilities, direct comparison to brand new improvements is often difficult. As such, appraisers are tasked with using techniques to infer value on newer improvements. These techniques include dollar/stall/REL (remaining economic life) and application of external depreciation, as found in the market.

The data represented in the graphs below is from Compeer Financial’s appraisal team, consisting of approximately 74 appraisers and support team members primarily across Wisconsin, Minnesota and Illinois. We also have staff that cover Idaho, Missouri, Indiana and Iowa. Compeer has a dedicated group of eight appraisers who specialize in the dairy industry. They locate the sales happening across the country -- and more specifically in the Midwest -- and analyze the arms-length sales.

Underlying Market Value

The first step is breaking out the underlying land values according to prices in that particular market area. The residual value gets applied to the improvements. There are three forms of depreciation that are considered to affect building improvements: physical, functional and external.

- Physical depreciation is typically from wear and tear and is a result of age and use.

- Functional obsolescence is market resistance caused by poor cow flow, parlor lacking in size, or even building something super adequate. Super adequacy is a result of building a structure that is “above and beyond” what is typical in the market.

- External obsolescence is caused by conditions outside the property like lack of demand, unfavorable economic factors, and availability of milk markets.

Impact of Milk Prices

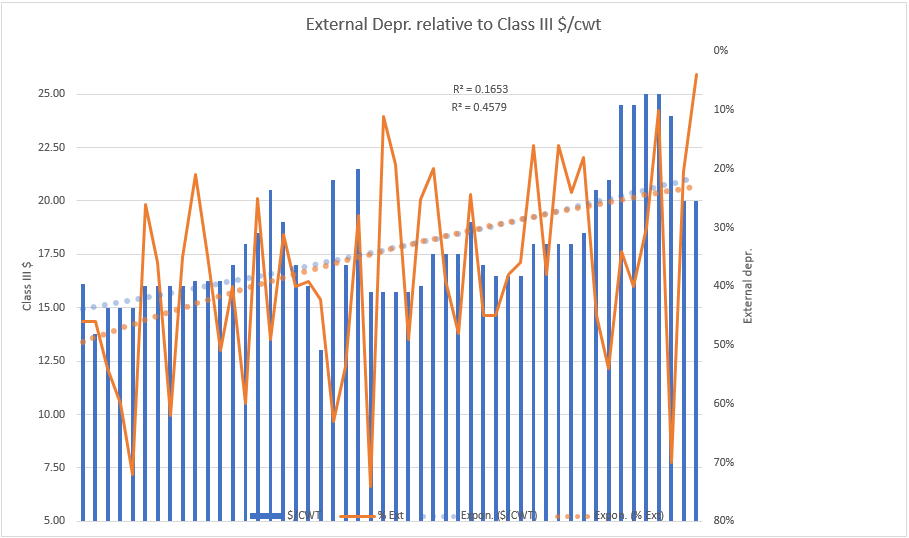

The following graph represents the analysis of 50 different dairy sales transacted from 2019-2022 throughout the states of Wisconsin, Michigan, Minnesota, Ohio, Iowa and South Dakota.

It shows the relationship that milk prices play on the external depreciation.

As milk prices increase, the external depreciation decreases and vice versa. In other terms, buyers tend to pay more for dairies when milk prices are higher. Subsequently, there isn’t as much external depreciation being placed on the improvements.

This all makes sense -- the market is willing to pay more when they are being paid more for their milk. What’s surprising is how direct the correlation is between sustained higher milk prices and the decrease of external depreciation. Ultimately, for appraisals completed during those higher milk price cycles, results in external depreciation having a more muted impact. When there isn’t as much external depreciation being applied, the buildings will hold more of their original value.

Construction Costs

Another significant consideration in the value of dairy improvement is construction costs. Inflation and supply chain issues have been on the top of everyone’s mind. New construction dairy improvements have not been immune. For instance, we have seen increases in bids for new dairy structures 25-40% higher than they were just a couple years ago. Additionally, given the price volatility of lumber, concrete and steel, contractors are reluctant to finalize bids until the eleventh hour on some projects. In other cases, necessary equipment is hard to get despite the price. With these hurdles some producers have elected to remodel existing improvements or purchase satellite facilities to expand operations. This has increased demand and increased prices.

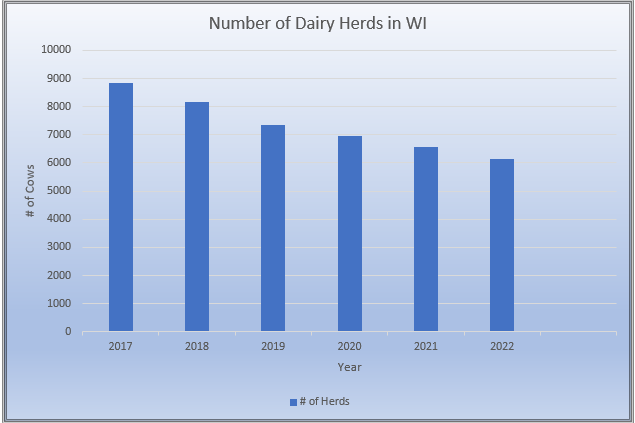

According to the USDA, there were 5,976 Grade A dairy herds in Wisconsin as of January 2022. One year later, the most recent report states that there are now 5,600 Grade A herds in Wisconsin. This is a6% decline of Grade A herds throughout the state. As the number of operations dwindles, herd size increases.

The average herd size for Wisconsin was 206 cows as of November 2022. This number keeps getting larger as each herd sells out. Many of these properties are typically smaller and not as economically viable as large operations. These facilities typically get used for storage, beef cattle, dairy heifer facilities and so on. Year after year there continues to be dairy operations deciding to sell the cows and close the barn doors. This trend will likely continue in the years ahead, while a number of smaller dairy farms exit the business and the larger dairy farms continue to expand.

Circling back to the original question of “Do high building costs affect the appraised value of my dairy facility?” The answer is yes.

Recent strong and sustained milk prices have improved working capital positions of profitable operations. Some of them are looking to expand, creating competition for existing properties. Secondly, high construction costs drive producers to consider alternative means of expansion. Some are considering off-site properties or retrofitting existing facilities to meet expansion goals. Both factors seem to be at play and pushing values upward on dairy properties.

While generally stronger prices on dairy improvements contribute to the overall real estate value, I would caution that there are many other considerations that come into play for the value of a specific operation, such as; size, layout, management styles and location, to name a few.

Check out various articles and resources regarding the Dairy Industry by visiting Compeer.com.