2023 Farmland Value Trends in Compeer Financial Territory

During 2022, we witnessed prime farmland selling in excess of $20,000 per acre, and this trend persisted throughout the balance of 2022 and extended into 2023. Though the rate of appreciation was not as dramatic as observed during the period between July 2021 and July 2022, the increase in value remains substantial.

Following is a brief snapshot of those benchmark changes from the 2022 to 2023 update.

Northern/Western Illinois

Illinois farmland is classified under a universally accepted soil survey system that breaks land down into quality classifications based on productivity indexes. While values and yields for each cropland type tend to vary by location, the relative productivity does not.

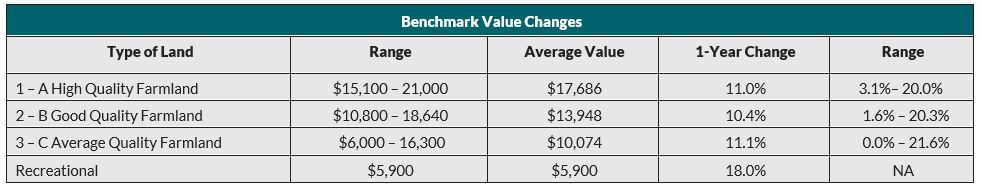

The chart below illustrates changes by cropland type for the northern and western Illinois benchmarks. Values across A, B and C farm types increased an average of +11.2%. One of 19 benchmarks was unchanged, seven were up less than 10%, six were up 10-20%, and five benchmarks were up in excess of 20%.

Central/Southern Minnesota

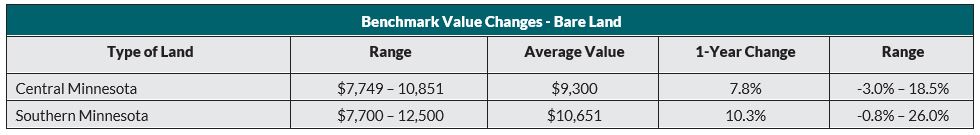

Minnesota is divided into two benchmark regions within the Compeer territory, with two benchmarks in the central region and eight in the southern region. Each benchmark is valued as improved and unimproved, focusing on land values, without considering building improvements. As a group, the benchmarks were up 9.8% year over year, with two down, three increasing less than 10% and four increasing 10-20% and one in excess of 20%. The chart below illustrates the changes by region.

Wisconsin

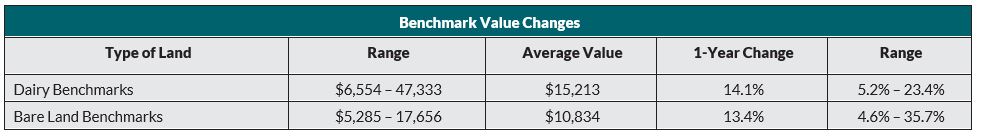

Wisconsin land values are not driven as much by cash grain prices as Illinois and Minnesota and show slightly different trends. Benchmark values in Wisconsin peaked between the 2013 and 2015 benchmark updates. Land values tend to be tied more closely with milk prices and strong demand from locally expanding dairy farms. While the benchmarks are shown as dairy and bare land in the table below, they are not necessarily separate benchmarks. In Wisconsin, we track values separately for five of the dairy/improved benchmarks. The higher per-acre benchmark is a highly improved dairy farm with buildings making up the predominant value, while the others are improved farms where land makes up the bulk of the value.

Despite concerns about potential negative effects on farmland values due to various headwinds, the values in the Midwest and within Compeer's territory remain resilient and robust. These headwinds encompass rising interest rates, escalating input costs, and lingering uncertainty surrounding commodity prices. While each of these factors has the potential to impact profitability individually, their combined effect could negatively influence farmland values.