Pork Industry Faces Uphill Battle as 2023 Losses Mount; Hope for Recovery in 2024

In 2023, pork producers are grappling with significant challenges, and the hope for a turnaround in 2024 is paramount. This year has witnessed unprecedented consolidated losses in the industry, leading to financial difficulties for many producers and prompting some to exit pork production. Unfortunately, this cycle of adversity seems to afflict the industry every decade or so, resulting in ongoing consolidation as profitability becomes elusive due to unprofitability and production issues.

Compeer Financial conducts quarterly financial analysis on producers within our portfolio, relying on audited statements or high-confidence review quality statements. The latest data, reflecting the second quarter numbers for 2023, confirms that the industry is still mired in severe financial stress.

Year-to-date figures reveal that the average producer incurred an operational loss of $16.44 per hundredweight (cwt.) before making risk management decisions. However, hedge activities provided a glimmer of hope, contributing an average gain of $7.60 cwt. Nonetheless, this only partially offset the losses, resulting in a net year-to-date loss of $9.64 cwt. or $20.69 per head by June 30. The primary driver behind these losses remains the persistently high operating costs, with producers averaging $91.41 cwt. after factoring in hedge activity in the first half of 2023.

The impact on the balance sheet has been as anticipated, with substantial declines in both working capital and owner’s equity since the start of the year. One key indicator for assessing the long-term viability of operations is working capital, with a standard benchmark of $600 per sow or sow equivalents. Sow equivalents apply to those who purchase part or all of their hog inventories. At the beginning of 2023, the average working capital per sow stood at an impressive $1,138, nearly double the required amount. However, this figure declined by $200 per sow in the first three months and another $143 per sow during the second quarter. Currently, the average producer retains $795 per sow in working capital. Fortunately, profitable months in July and August provided some relief, enabling an increase in this figure as the industry enters the fourth quarter. Owner’s equity has also been impacted, with the average producer’s equity standing at 51% by the end of the second quarter, down 3% from the first quarter’s end.

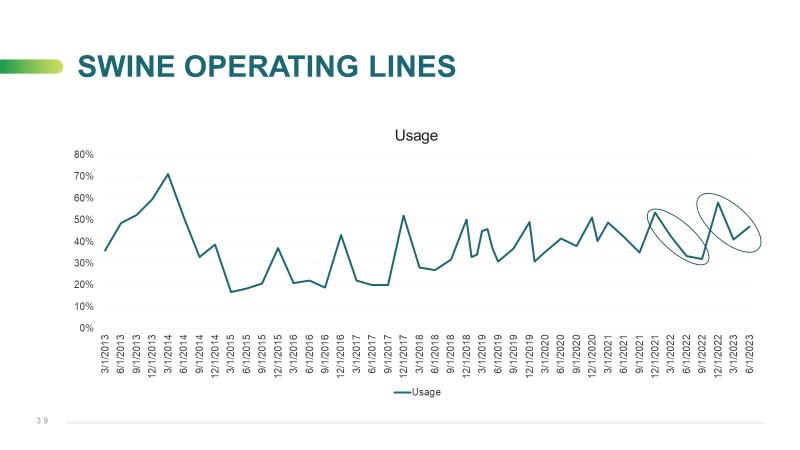

As expected, the average usage of operating lines of credit continues to rise. Typically, usage rates would decrease and hover around the mid-30% range through the second quarter. However, the illustration below demonstrates that the average advance rate for producers is now nearing 50%, and with anticipated losses for the remainder of 2023, it may climb to around 60%.

Nevertheless, there is optimism on the horizon. Reports indicate that corn yields are surpassing expectations, and December corn futures are currently priced at around $4.80. Compared to the $7.00 corn prices observed a year ago during the harvest season, this suggests potential savings of at least $20 per head in feed costs. Coincidentally, this figure aligns closely with the per-head losses experienced in the first half of 2023. As high-priced hogs are replaced with animals consuming lower-cost feed, there is a possibility of alleviating working capital requirements. However, producers must brace themselves for the next two quarters, as further balance sheet deterioration is expected to due to ongoing losses. However, with lower feed costs and positive profit margins anticipated for the summer, the industry may start rebuilding balance sheets in the second quarter.

Steve Malakowsky is the Director of Swine Lending, with over 25 years of experience at Compeer. For more insights from Steve and the Compeer Swine Team, visit Compeer.com