Benchmarking the Bottom Line: Grain Report Reveals Resilience

Farmers have always been experts at navigating uncertainty, and 2024 was no exception. Despite continued pressure from high input costs and tight margins, producers across the Midwest kept pushing forward, leaning on smart financial strategies and operational discipline. Compeer Financial's latest Grain Financial Peer Report shows just how hard today's farmers are working to make every acre count. This year’s data highlights both the economic challenges and the unwavering determination of producers who continue to adapt, adjust and move forward — even when the numbers get tight.

|

Compeer annually compiles client financial data into a Grain Financial Peer Report that provides a comprehensive look into the financial and operational performance of grain producers across key metrics.

The report compares the current year results with three-year averages, best-in-class benchmarks and industry targets. This peer-based benchmarking tool is critical for identifying strengths, weaknesses and opportunities in managing your farm. Analyzing your strengths and weaknesses on an annual basis in comparison to your peers can help guide future decision making for your operation.

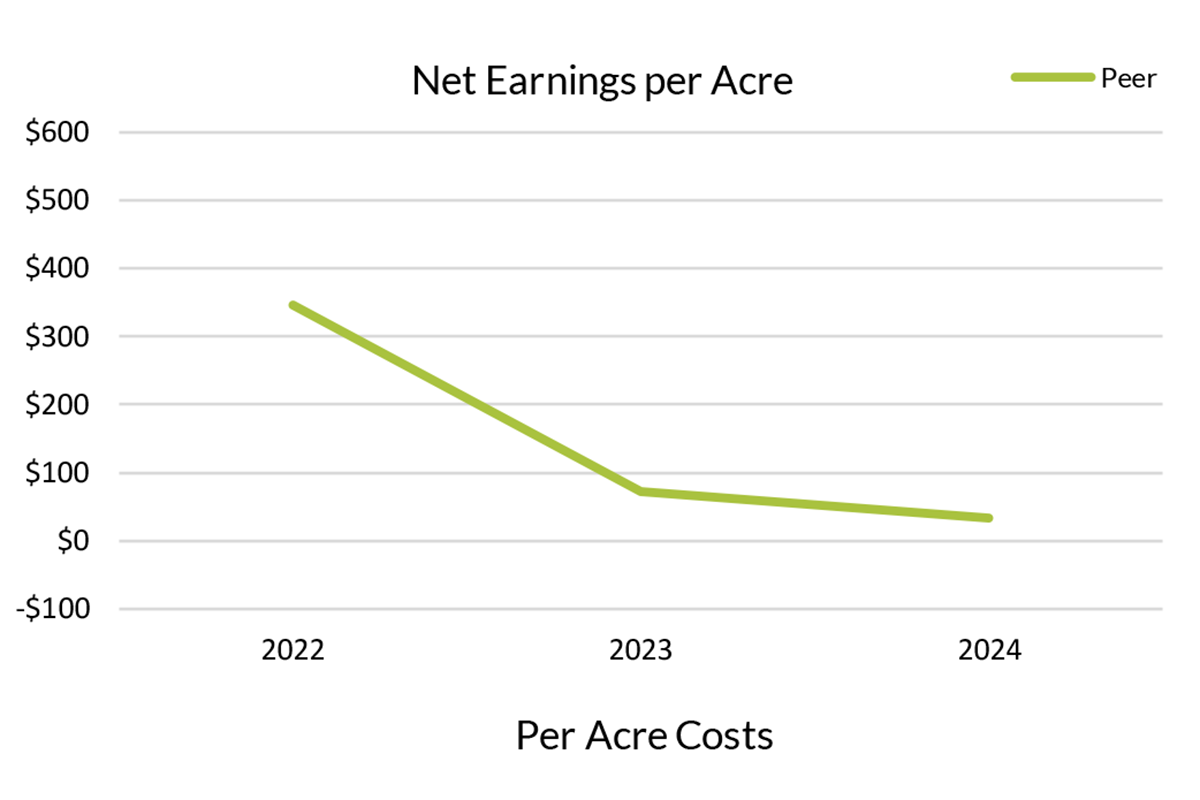

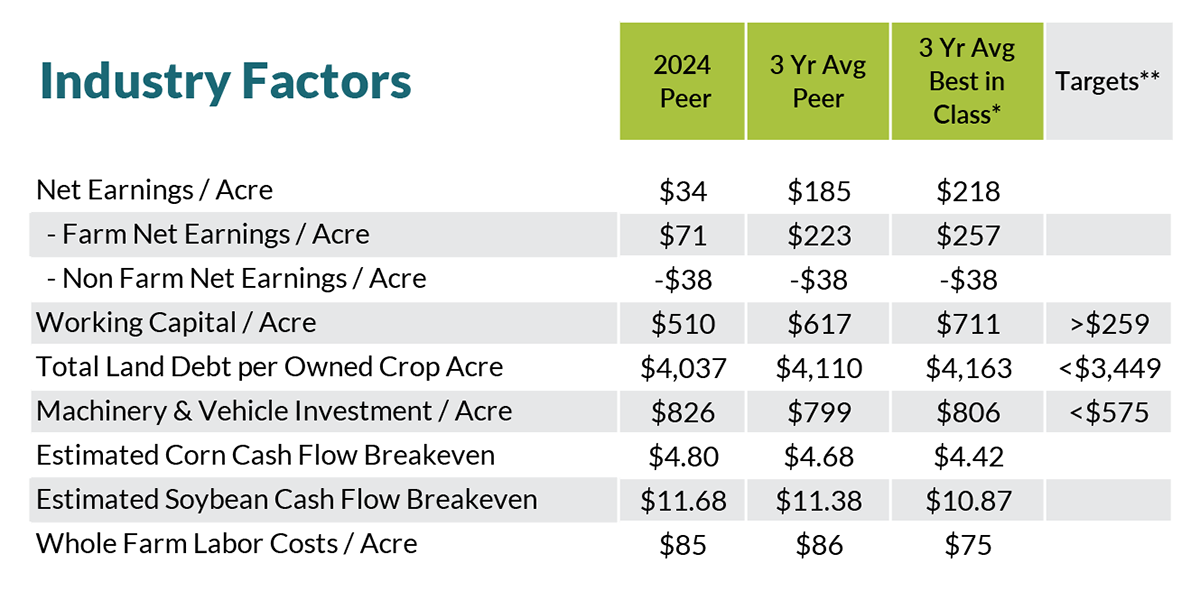

Farm financials in 2024 remained very similar to 2023. 2024 profit levels in the Midwest continued to trend down as compared to previous years. Land and input costs remained high in 2024, while grain prices remained low keeping margins tight for many producers. As a result, average net earnings per acre decreased from $346/acre in 2022, to $71/acre in 2023 and $34/acre in 2024, as shown below.

Crop Revenue Down Along with Grain Prices

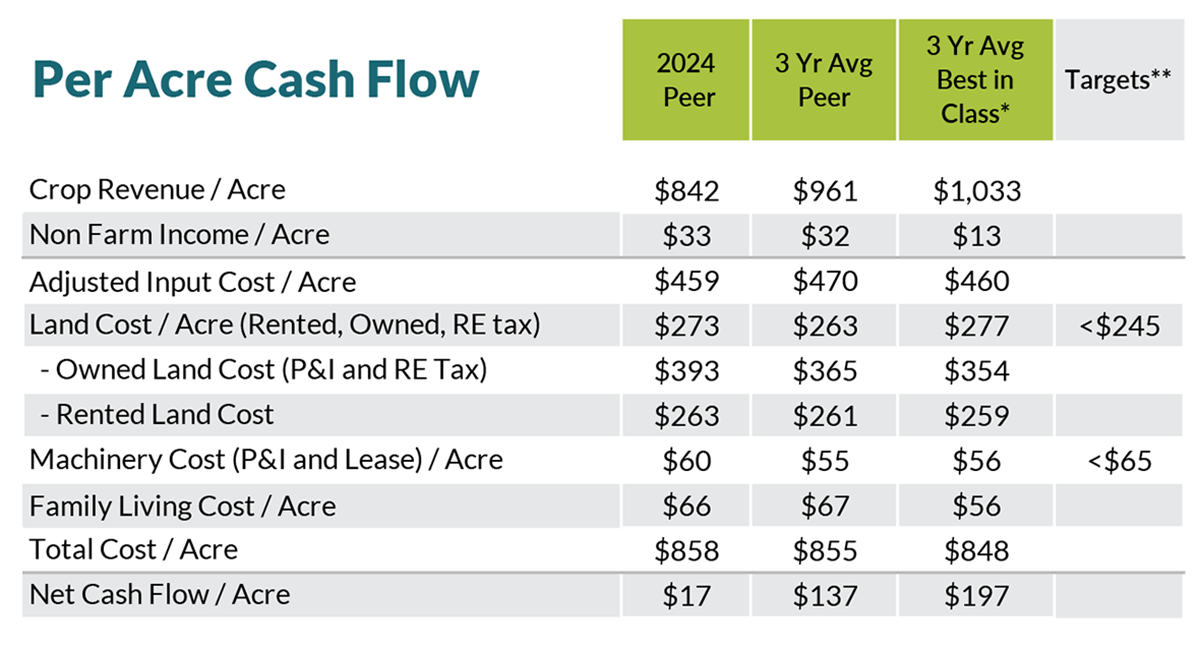

Crop revenues continue to trend downward, with the average peer group crop revenue decreasing from $945/acre in 2023 to $842/acre in 2024. This also pulled the 3-year average down from $1,017/acre in 2023 to $961/acre in 2024.

Managing through Lower Margins

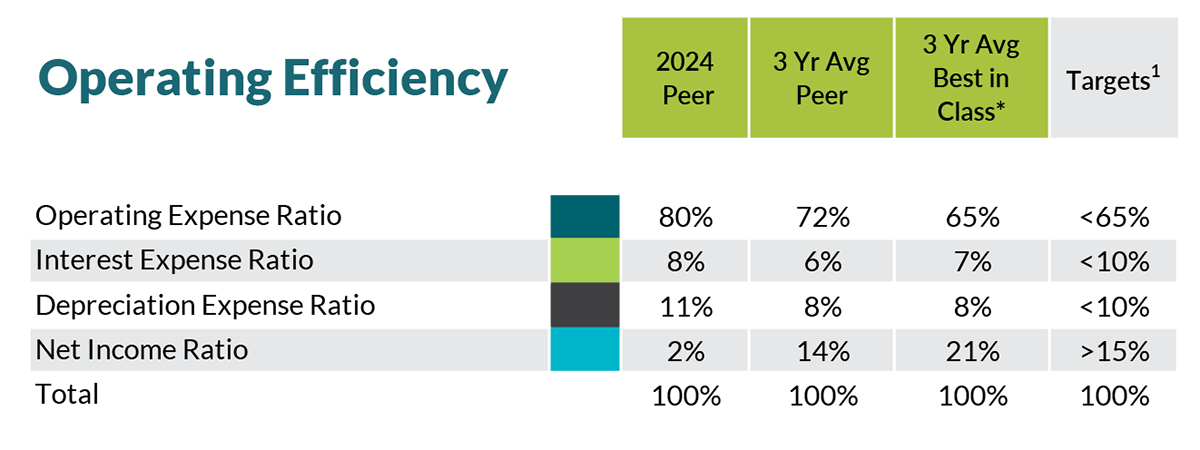

Because land and input costs remain high, operating and interest expense ratios continue to creep upwards. OER increased to 80% in 2023 and 2024 as compared to 61% in 2022. That loss of 19% of margin directly hit the bottom line for farmers.

|

With farmers having to dip into working capital to cover term debt payments, working capital levels are decreasing. Producers are utilizing operating and term loans more often, resulting in higher interest expenses. The 2022 interest expense ratio was 3.90% and increased to 5.88% in 2023 and up again to 7.61% in 2024.

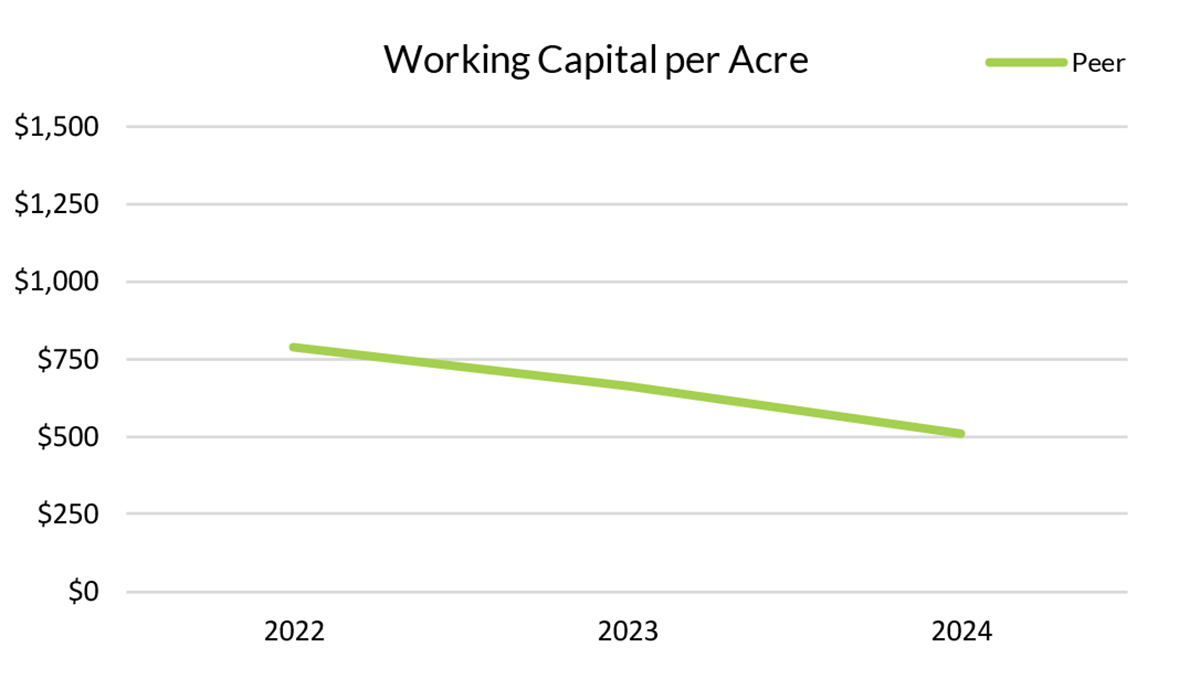

Working capital levels continue to migrate downwards. Working capital per acre levels decreased more than $275/acre from 2022 to 2024. This is causing producers to more heavily rely on borrowed funds in order to cashflow their business, which is also contributing to higher interest expenses.

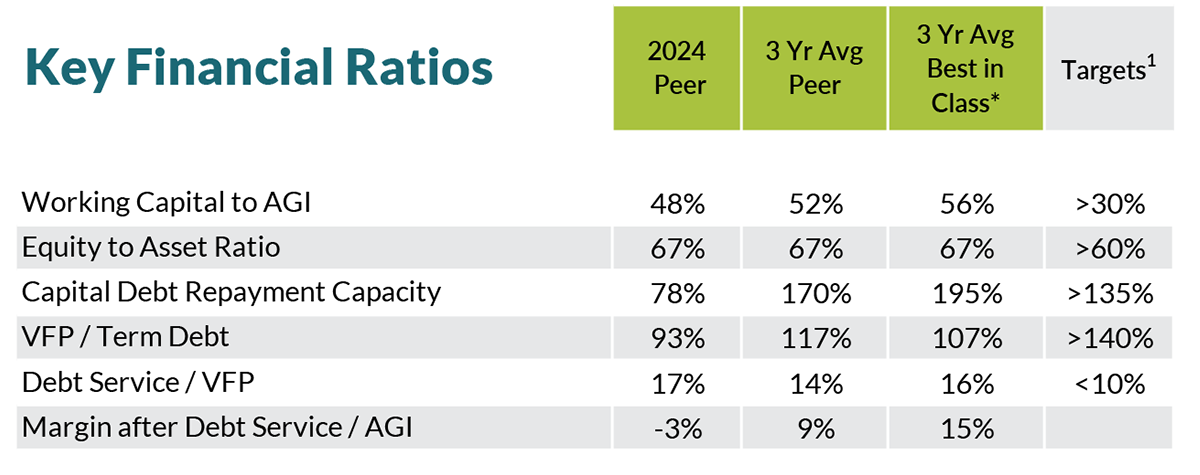

With revenues down in 2024, it is no surprise that debt service per value of farm production (VFP) increased from 14% for the 3-year average to 17% in 2024. VFP is calculated by dividing the current principal and interest payments by the value of farm production. A larger portion of an operation’s revenue was used for term debt payments in 2024.

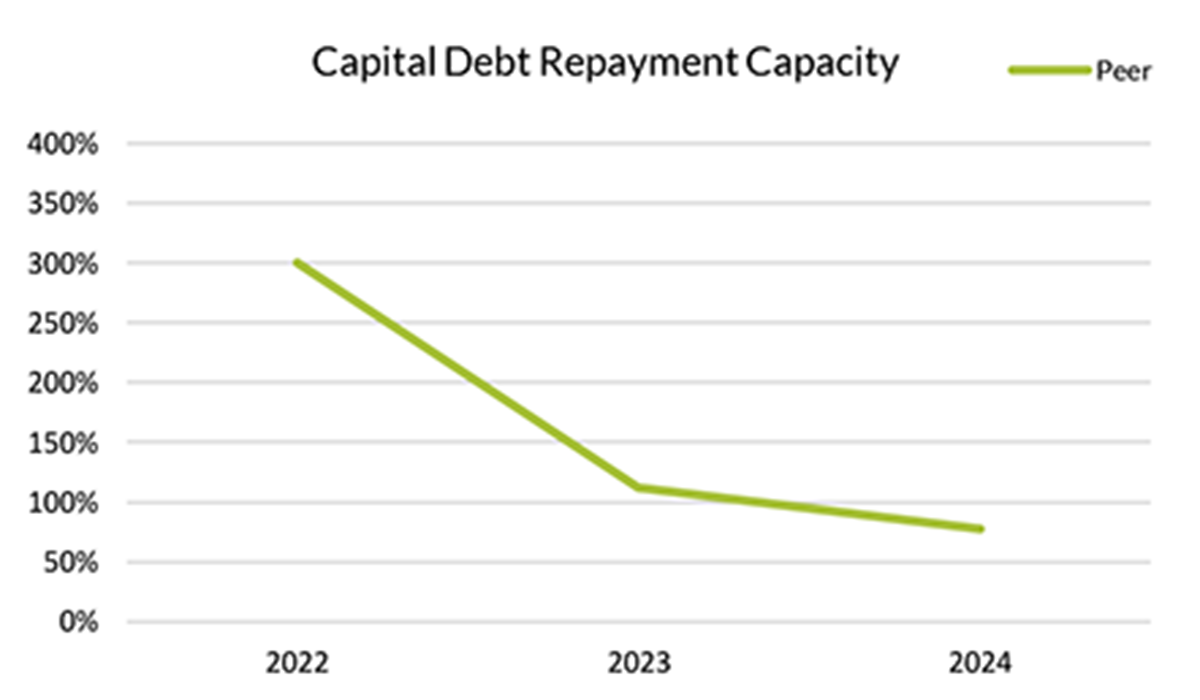

Capital debt repayment capacity (CDRC) significantly decreased by more than 300% in 2022 to 111% in 2023 and 78% in 2024. Target for CDRC is 115% or greater. 100% would indicate coverage of all debt payments, with additional profit going towards capital purchases and/or working capital. While producers were able to cover all their term debt payments in 2023, they fell short in 2024 and that is why we see working capital levels deteriorating.

Tighter margins in 2023 and 2024 are starting to show on producer’s balance sheets. While there is still a lot of resiliency built up from 2020-2022 to propel us into 2025, a lack of marketing opportunities in 2025 makes the outlook look bleak for improved farm earnings in 2025.

To learn more about how to financially benchmark your operation and see how your farm stacked up to three-year averages and peers, reach out to your local Compeer financial officer. And check out our Grain Margin Manager – a free tool to help you monitor profitability.

Benchmarking Basics

Benchmarking is a powerful tool farmers can use to better understand and improve their operation. Compeer can help you see how you stack up against other producers and guide you to meet your goals.

Grain Margin Manager

Self-Paced eLearning

Access self-paced courses covering a wide range of farm financials.