Boom or Bust in the Current Farmland Real Estate Market?

Over the past few years, land prices have continued an upward trend, defying expectations that market conditions should have hindered their trajectory. What continues fueling this market?

Farmland has become an attractive asset class for institutional investors seeking diversification, stable returns and to hedge against inflation. This increased interest from non-traditional investors can contribute to rising demand and higher prices.

Green energy continues to be an emerging market and many energy companies are willing to pay lucrative lease rates. These positive returns can put an upward pressure on values.

Recreational land is also defying traditional trends. The recreational market currently has a very strong demand. This is blurring the lines of pricing where recreational and low-quality farmland are selling at similar values.

Market Influencers

Investor interest, supply and demand dynamics, green energy expansion and recreational markets are not the only influencers fueling the traditional farmland value market.

RATES

Many buyers are considering not only the present farm property value, but also the prospect of rising farmland values in the future if action is postponed. Purchases in today’s market secure the property now, with hopes for an increase in farm value over time coupled with the expectations that interest rates will decrease sometime in the future.

ECONOMY

Continued inflation in the cost of goods has a ripple effect, eventually reaching farmers. As the overall price level rises, producers often face increased expenses for raw materials, labor and other inputs. These higher production costs put stress on profit margins and present a challenge to farmers navigating this inflationary environment while seeking to maintain profitability.

COMMODITY MARKETS

During prosperous years marked by upswings in commodity prices, farmers often find increased confidence to pursue property purchases. Conversely, during downswings or less favorable periods in commodity markets, producers and investors may adopt a more cautious approach. Economic uncertainties and lower profitability can lead to a reluctance to engage in significant financial commitments, including land purchases.

Values Sustainable?

In a landscape where land becomes increasingly scarce amid a growing population with diverse demands, it appears that the supply of available land will consistently fall short. This constant demand suggests a logical long-term stability in values. Nevertheless, short-term variations can arise due to shifts in market influencers. Projections for 2024 indicate that commodity prices will remain subdued and inflation will persistently strain profit margins. Investor sentiment tends to be pessimistic in a bearish market, hinting at a potential modest market correction in 2024.

Benchmark Trends

The Compeer Financial appraisal department manages 53 benchmark farm land properties throughout Minnesota, Wisconsin, Illinois, Iowa and Indiana. These benchmarks are appraised on a monthly basis for real-time market trends. This data helps us stay abreast of what’s going on in the agriculture real estate market.

The 2023 farm real estate appraisal reports showed an overall stable market. Review results, separated by each state in our territory, below. Sign up for our monthly appraisal e-newsletter for data and analysis throughout the year. And subscribe to our Appraisal Report podcast for insights and expertise on all things farm real estate from our team of appraisers.

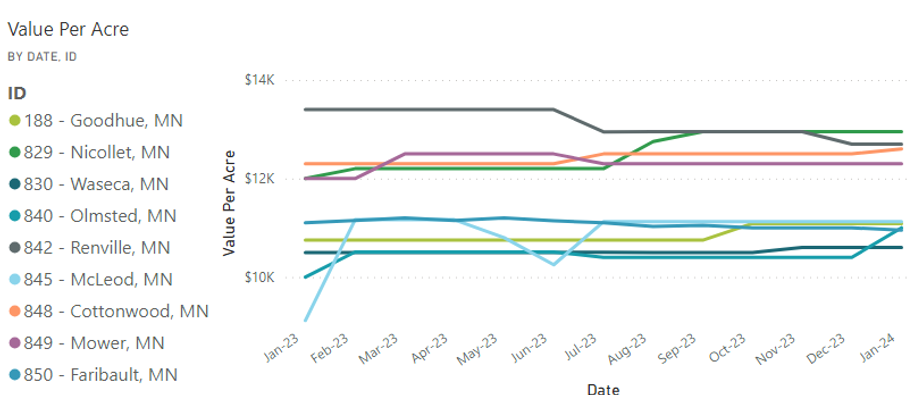

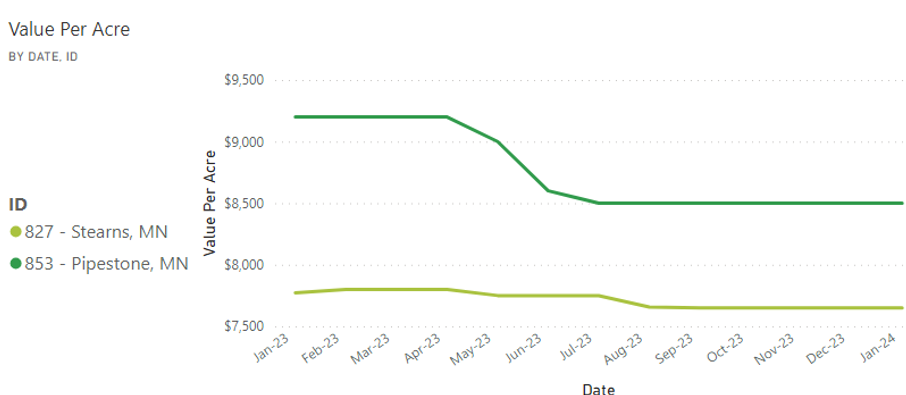

MINNESOTA BENCHMARKS

The Minnesota benchmarks are located primarily south of Interstate 94 and across the southern portion of the state from east to west. From mid-2023 to the end of the year, the market for tillable land began to stabilize across all land classes. The trendline for class C cropland indicates a significant rise followed by stabilization. This was influenced by the recreational market converging with low-quality cropland, as both are being sold for similar values.

Cropland A

Cropland B

Cropland C

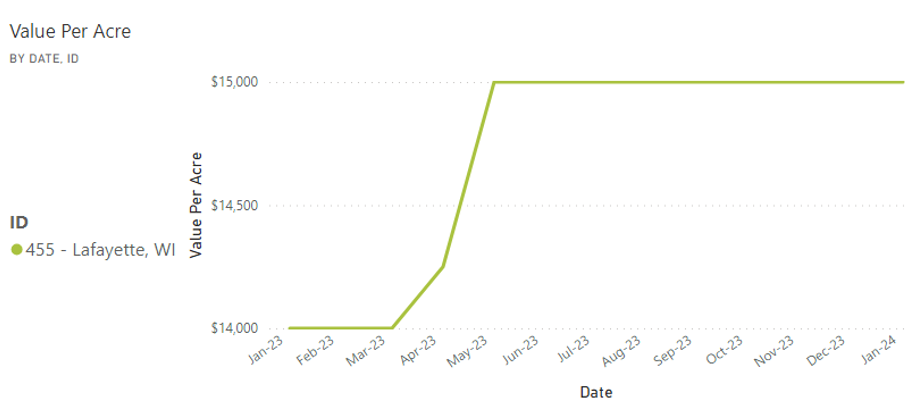

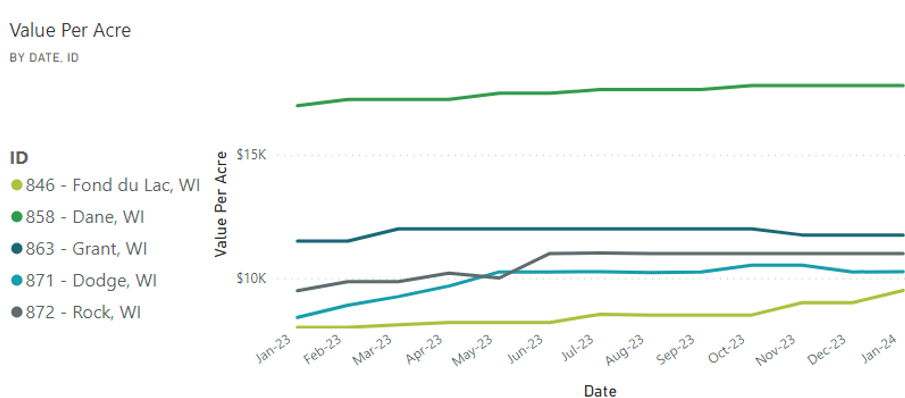

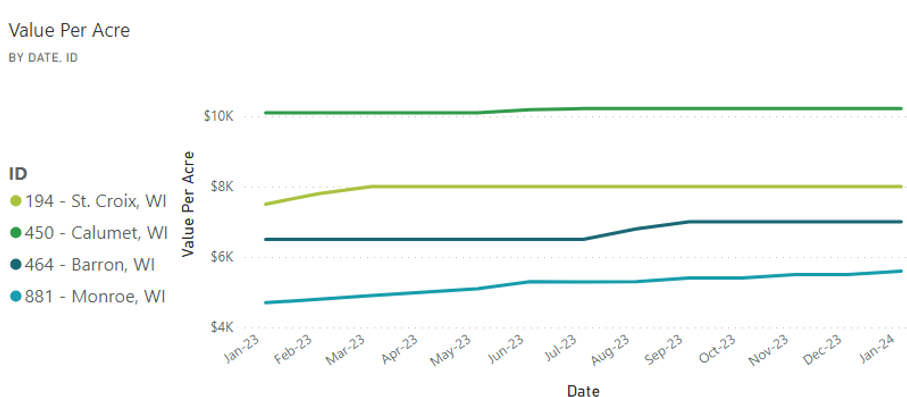

WISCONSIN BENCHMARKS

The Wisconsin benchmark locations follow the border lines of the state starting south of the Green Bay area, wrapping around Madison, over the La Corsse and past Eau Claire into the northwest regions of the states. Benchmarking is not established in the northeastern parts of Wisconsin due to the area's dense forestry. As the trendlines show, Wisconsin as shows a stable rural land market from mid-2023 to year-end.

Cropland A

Cropland B

Cropland C

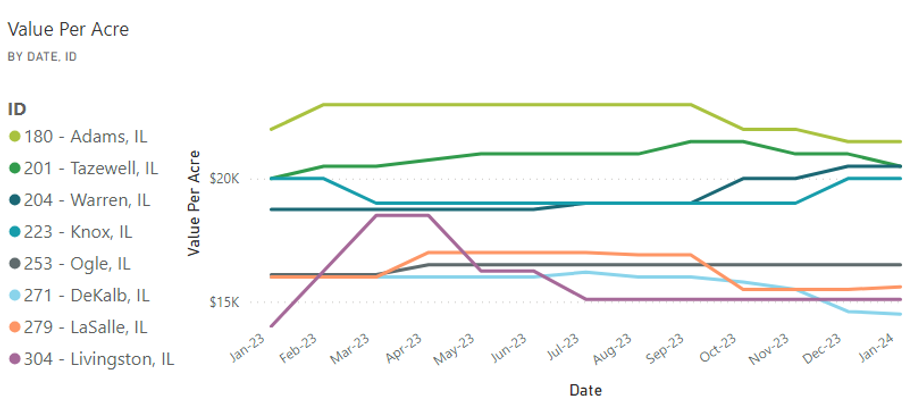

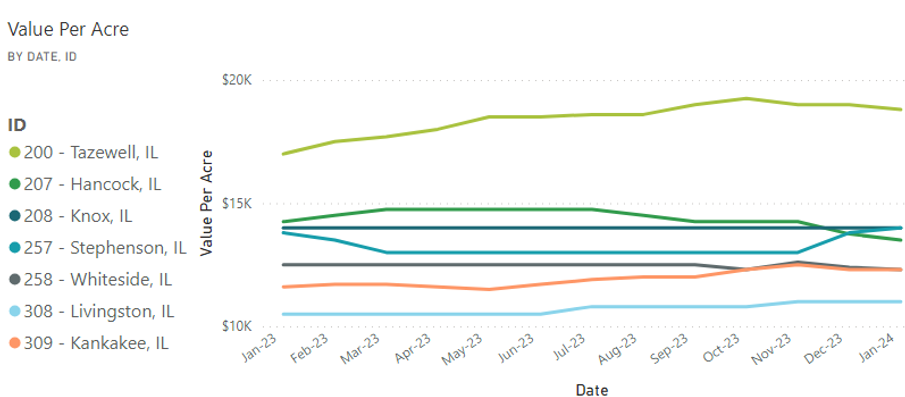

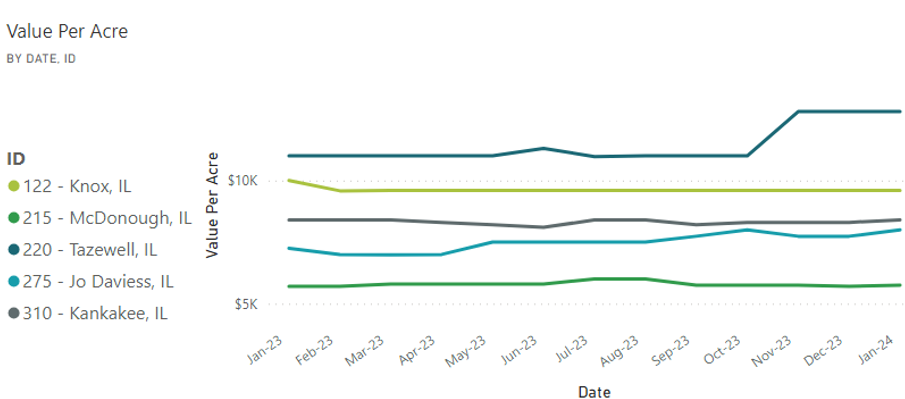

ILLINOIS BENCHMARKS

The Illinois benchmarks are all located across the central and northern portions of Illinois – all north of Interstate 72. This area is well-known for its rich black dirt with high levels of productivity. Illinois trendlines have been fairly stable for class B and C farms, while the class A farms showed a bit more volatility toward the fourth quarter of 2023. Overall, the farmland market has been stable throughout 2023 with a decrease in the volume of sales.

Cropland A

Cropland B

Cropland C

Suite of Appraisal Products

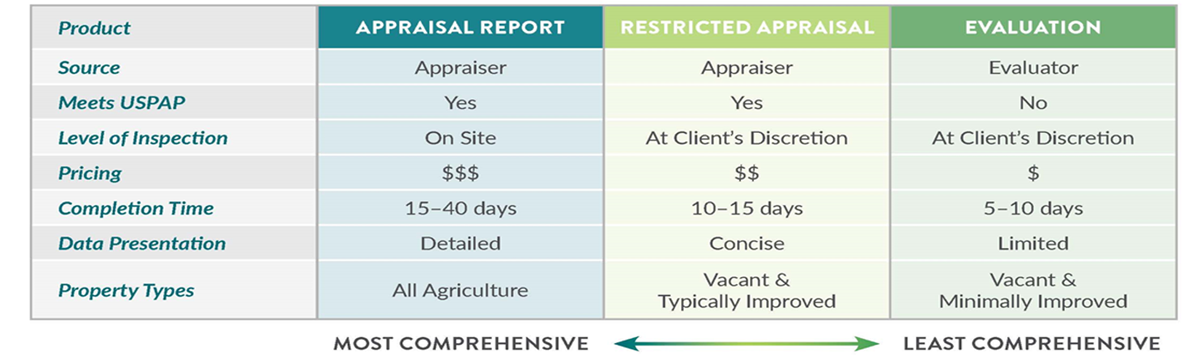

The appraisal report stands as our most comprehensive product, conducted by a certified general appraiser. This report type is suitable for all agricultural property types, and essential for specialized properties.

The restricted appraisal offers a more focused approach, concentrating specifically on the subject property and its value. This product is ideal for vacant cropland or minimally improved properties with typical agricultural structures.

Introducing our newest offering, the evaluation, is conducted by a qualified evaluator. This non-Uniform Standards of Professional Appraisal Practice (USPAP) compliant assessment is particularly well-suited for vacant cropland properties.

Reach out to the local appraiser in your area to discuss your appraisal needs.