Developing your Dairy Revenue Protection Plan

Dairy Revenue Protection (DRP) has emerged as a valuable asset for dairy producers in their risk management toolkit since it was first introduced in 2018. In 2020, the program reached its zenith, covering 38% of U.S. milk production. Establishing an effective DRP plan involves considering various factors. Here are key aspects to ponder:

1. DRP Coverage Options

Assess your market exposure by engaging in discussion with your field representative or processor. This dialogue can help you better understand the compensation structure for your milk. DRP offers flexibility in selecting coverage from Class III, Class IV or Components, allowing you to leverage all three options. If opting for multiple coverages, I would encourage you to separate Class III and Class IV endorsements for independent settlements.

2. Determining Amount of DRP Coverage

Evaluate total production quarterly and collaborate with your lender or farm manager to establish a breakeven number. Conducting financial stress tests can aid in determining the appropriate production to cover. Employing a protection factor, ranging from 1.0 and 1.5, enhances coverage. Producers can strategically use a factor higher than 1.0 to increase payments in a claim scenario. Alternatively, covering fewer pounds with a 1.5 protection factor maintains effective coverage, leaving room for additional production if market conditions improve.

3. Timing of DRP Coverage

Avoid the trap of seeking a perfect moment for risk management. Instead, implement a consistent “layering” plan, purchasing DRP coverage for the same quarter on multiple days. This approach removes emotion from decisions, providing more reliable coverage if the market declines. DRP safeguards against downside risks while allowing potential gains from market price increases. Historical analysis suggests initiating coverage 6-12 months ahead, aiming for attractive price levels.

To demonstrate the effectiveness of a layering strategy, I conducted a simulation based on data from 2020-2023. In this scenario, a Minnesota producer opted for DRP coverage, securing 100% Class III at the 95% coverage level with a 1.0 protection factor, yielding positive outcomes. The simulation involves purchasing coverage ten months before each quarter and acquiring 10% of the total coverage on a monthly basis.

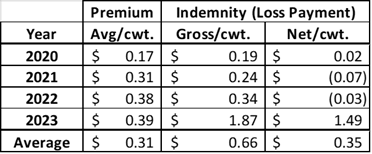

Table 1 outlines key metrics on a hundredweight (cwt.) basis, including average premium paid, gross indemnity and net indemnity (after deducting premiums). Over the four-year period, the average premium paid per cwt. was $0.31, while the net indemnity (after premiums) amounted to $0.35/cwt. Despite a slight below-breakeven performance from 2020 to 2022, the strategy ultimately proved effective. By Q4 of 2023, it marked the 6th consecutive quarter of receiving an indemnity through DRP.

To provide context, I compared the simulation results with actual data, evaluating the average net indemnity across all Class III Endorsements that ended in 2020-2023 in Minnesota. The average net indemnity for all Minnesota endorsements was $0.20/cwt, notably lower than the $.35/cwt observed in my example.

**The 2023 Q4 data was approximated at the time of this article. USDA AMS numbers were not yet finalized.**

Dairy Revenue Protection (DRP) stands out as a potent tool for mitigating price risks for dairy producers. Drawing from years of data, I recommend developing a consistent strategy, ensuring ongoing coverage and reaping the benefits of the program. Regularly evaluating and adjusting your DRP strategy is essential to align with changing market dynamics and protect against potential risks appropriately.