Find the Power in Farm Peer Benchmarking for Growth

What is Benchmarking and Why Should You Use It?

Benchmarking is the process of comparing your farm's financial performance against similar operations to evaluate where you stand. It helps you understand how your farm compares to others in terms of key financial metrics and highlights areas where you can improve. This gives you valuable insights into where your farm is succeeding and where adjustments may be needed to reach your financial goals.

Benchmarking your farm can help you:

- Identify strengths and weaknesses: By comparing financial ratios and performance indicators, you can pinpoint areas that need improvement and areas where you're excelling.

- Set goals and track progress: Benchmarking provides measurable targets, enabling you to track progress toward achieving financial stability and growth.

- Make informed decisions: With a clear view of your financial position compared to others in the industry, you can make more data-driven decisions for your operation.

- Manage risks effectively: Understanding how your farm's performance stacks up against others helps you identify potential financial risks and take steps to mitigate them.

|

Track Your Progress: Start with Quality Financial Data

Before diving into benchmarking, ensure you have quality financial data to work with. Accurate data is crucial for meaningful comparisons. Some essential financial documents to maintain include:

- Accurate year-end balance sheet: This provides an overview of your farm's assets, liabilities and equity at the end of the year. It’s essential for measuring your farm's overall financial health.

- Accrual-adjusted earnings statement: This statement accounts for revenue and expenses as they occur, rather than when cash transactions happen, giving you a clearer picture of your farm’s financial performance each crop year.

- Annual tracking of scope and production: Keep track of your farm’s scope (acres and yields) to better track your production goals and how that affects profitability.

- Record family living expenses: Documenting family living expenses helps you understand the true cost of supporting your household while also managing the financial needs of the farm.

Having these key financial documents will allow you to perform accurate and effective benchmarking annually.

Data-driven Insights: Analyzing Strengths and Areas for Improvement

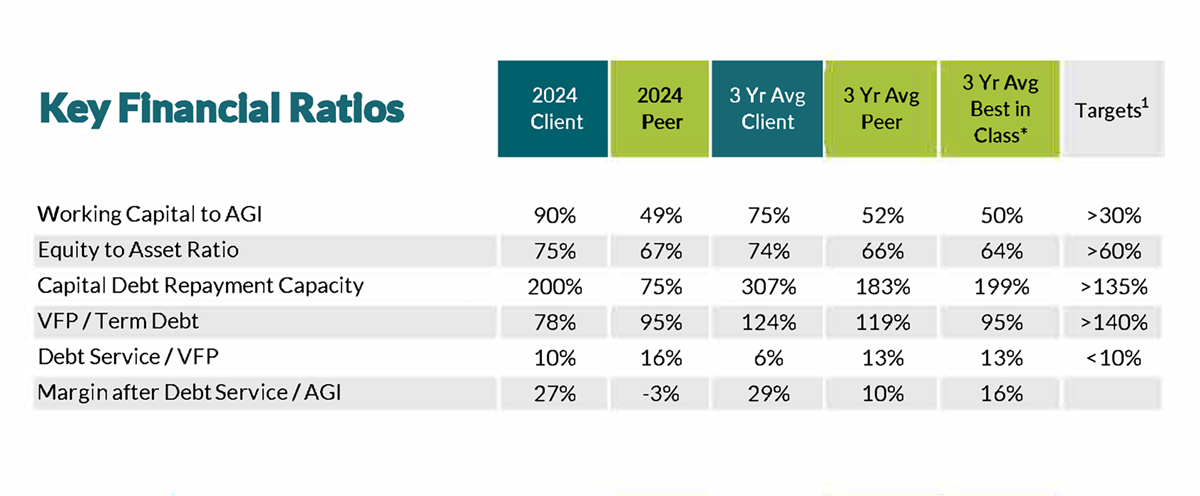

Once you have quality data, it’s time to dig into the numbers. Here are some essential financial ratios to consider when benchmarking your farm.

Working Capital to Adjusted Gross Income (AGI):

This ratio helps determine whether your farm has enough cash reserves to meet short-term obligations, like paying bills and servicing debt. To calculate it:

- Working capital = current assets - current liabilities

- Working capital to AGI = working capital ÷ AGI

A healthy working capital ratio indicates the farm has enough liquidity to cover its expenses and invest in growth.

Equity to Asset Ratio:

This ratio measures the financial stability of your operation by comparing your net worth to the value of your assets. To calculate it:

- Equity to asset ratio = net worth ÷ total assets

A higher ratio suggests that your operation is less reliant on debt and is more financially solvent, which lowers financial risk.

Capital Debt Repayment Capacity (CDRC):

This metric evaluates your ability to repay debt, considering both farm and non-farm income. It helps assess whether your operation can handle debt servicing without risking financial distress. To calculate it:

- Capital capacity = net farm income + depreciation + interest on term loans + non-farm income – family living

- Capacity demands = scheduled principal and interest payments on term debt + working capital deficiency (if applicable) + capital asset replacement (if applicable)

- Capital debt repayment capacity = capital capacity ÷ capital demands

Farms should aim for a target of greater than or equal to 115%.

Margin after Debt Service to AGI:

This ratio measures your farm's profitability after all expenses, including debt service, family living and taxes. To calculate it:

- Margin after debt service = income - (loan payments + family living expenses + taxes)

- Margin after debt service to AGI = margin after debt service ÷ AGI

A target margin of 10-20% is considered healthy, meaning that after covering all essential expenses, you still have enough remaining to reinvest or save for future challenges.

By tracking these financial metrics, you can assess your farm’s overall health, identify potential risks and make informed decisions to improve profitability and financial stability.

Compeer Financial can help you with benchmarking your operation. Talk to your local Compeer financial officer about our Financial Peer Reports, where we can help use your operation’s data to identify competitive advantages, areas for improvement and establish your financial goals.

What Sets "Best in Class" Farmers Apart: Ben…

Ready to join the “Best in Class”? Explore how higher yields, lower costs, and strong financial management lead to long-term profitability for farmers.

Benchmarking Basics

Benchmarking is a powerful tool farmers can use to better understand and improve their operation. Compeer can help you see how you stack up against other producers and guide you to meet your goals.

-1200x300-b5450cf.png?ext=.png)

-270x321-9bf01ea-(1).png?ext=.png)