Flat but Firm Farmland Values: What’s Driving Today’s Market

The farmland market across Illinois, Wisconsin and Minnesota started 2025 on stable footing. After several years of rapid value increases followed by cautious slowdowns, land prices have now leveled out, creating a more predictable and measured environment for buyers and sellers alike.

Compeer Financial’s appraisal team monitors 53 benchmark farmland properties across five states – Illinois, Minnesota, Wisconsin, Iowa and Indiana – tracking monthly data to understand shifting market dynamics in real time. The first half of 2025 tells a story of resilience: steady values, balanced sales activity and consistent buyer interest, all in the face of broader economic pressures, interest rate uncertainty and evolving trade policies.

We’ll break down state-specific trends, examine key factors influencing farmland values and explore what current indicators suggest for the remainder of 2025. Whether you’re considering buying, selling or holding land, these insights can help guide informed decisions in a market that remains stable but watchful.

Be sure to subscribe to Compeer’s monthly appraisal e-newsletter and the Appraisal Report podcast for expert updates and in-depth analysis throughout the year.

|

Benchmark Trendlines

The Compeer appraisal team’s 2024 year-end farmland value outlook anticipated a cautious market heading into 2025 – and that prediction is proving accurate. Through the first half of the year, farmland values in Illinois, Wisconsin and Minnesota have remained steady, with no significant upward or downward shifts – a clear sign of a restrained and measured market environment.

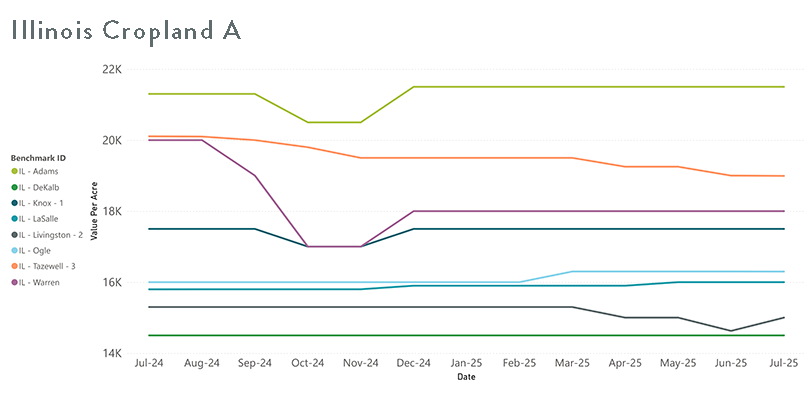

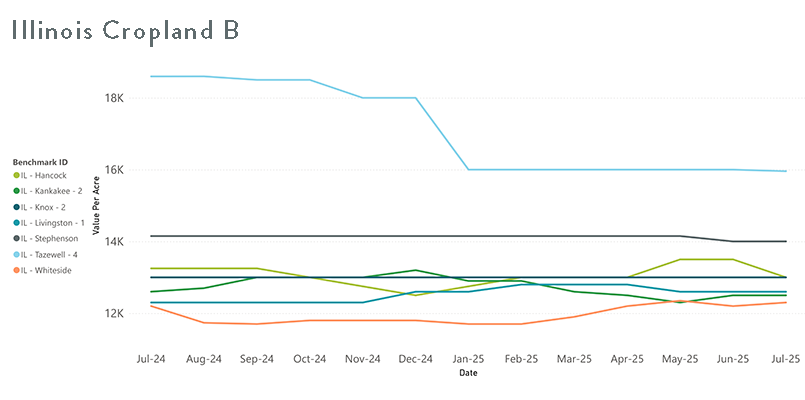

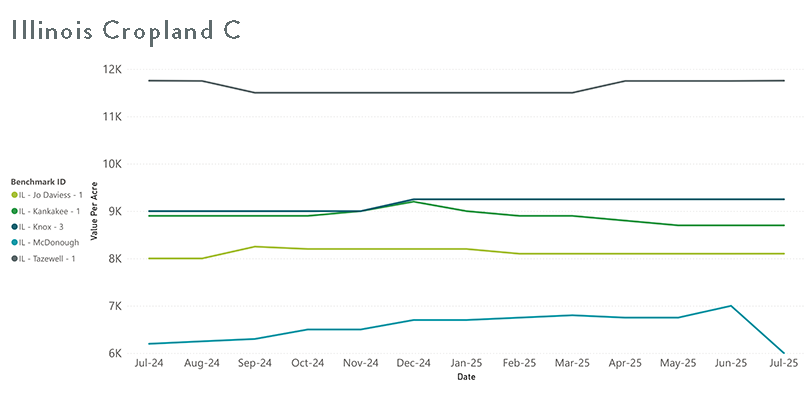

Illinois

Compared to the same time in 2024, Illinois farmland values in the first half of 2025 have shown remarkable consistency. While 2024 ended with a cautious approach in land values across most regions, 2025 has introduced a steadier rhythm, with only minimal changes in pricing – typically within a 3-5% range. This flattening trend indicates a market that is no longer adjusting from the rapid growth seen in earlier years, but instead settling into a more balanced and predictable pace.

Sales activity has returned to more normalized levels, with auction platforms continuing to generate the strongest prices. Marketing times have also stabilized, generally ranging from 30-120 days, signaling consistent buyer interest and renewed market confidence.

Looking forward, Illinois is expected to maintain this steady course barring any major economic shifts.

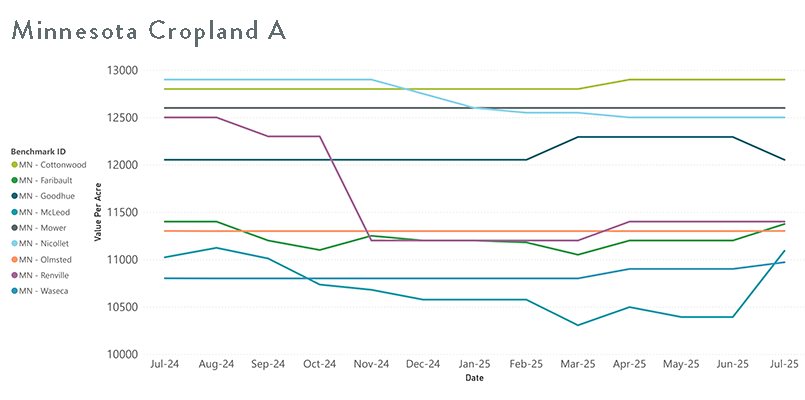

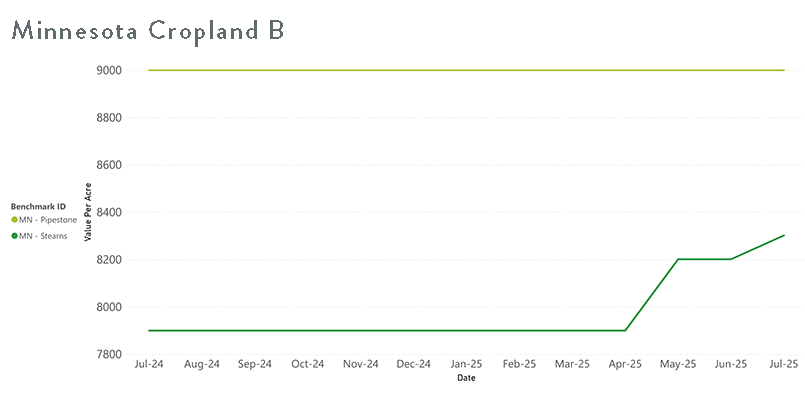

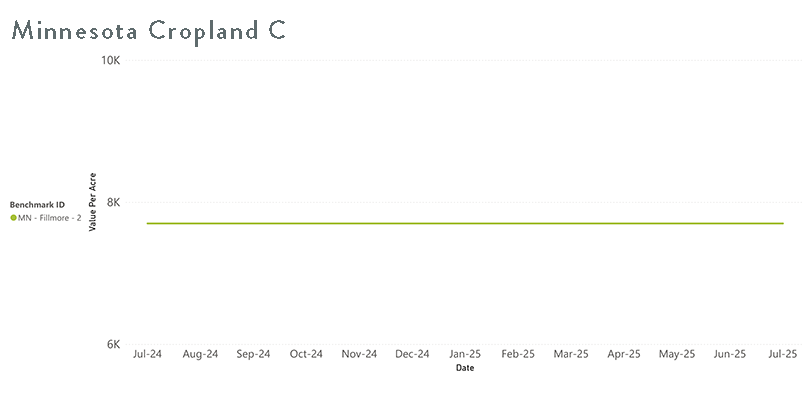

Minnesota

While 2024-year end results showed some variation between individual benchmarks in Minnesota, agricultural land values increased as a whole at a slightly stronger rate than the year prior with many counties showing an increase in sales volume as well. In contrast, 2025 has been much more limited in terms of the number of transactions that have occurred in the state. There is a sense from buyers and sellers alike that there may be unforeseen benefits on the horizon related to real estate transactions and general economic conditions with the current Congress and Presidential administration. In general, the sales that have occurred thus far in 2025 have been fairly consistent with 2024 values.

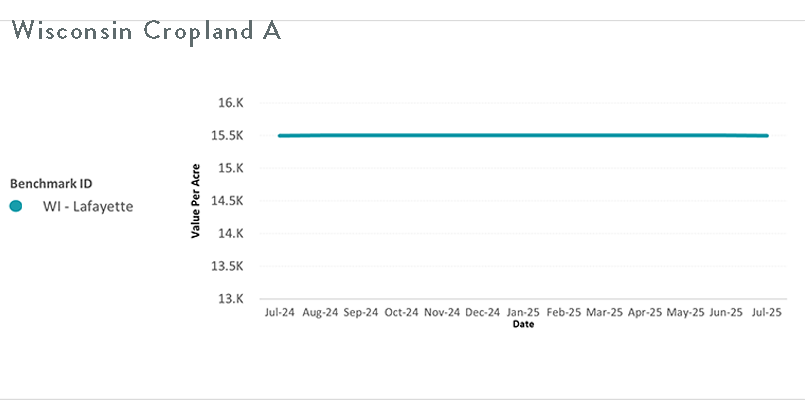

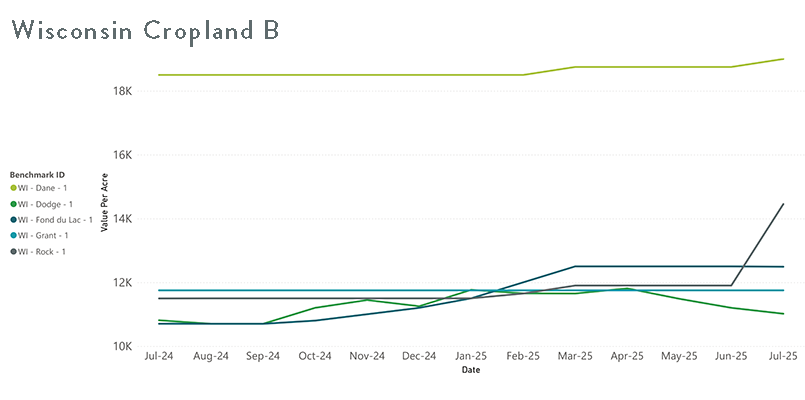

Wisconsin

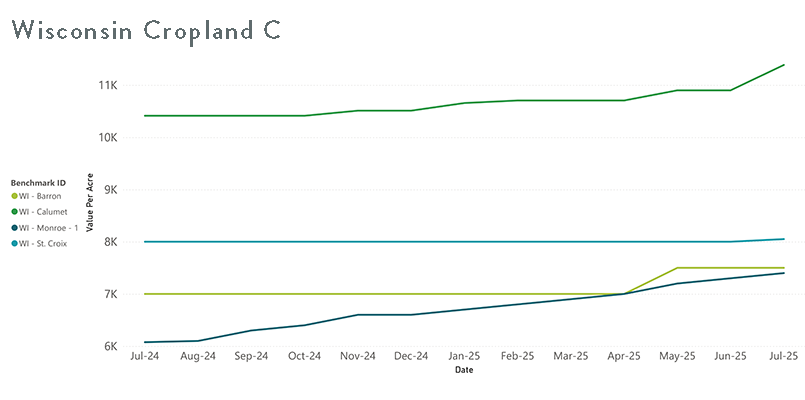

Land values continue to be stable to slightly increasing in value for the first half of the year in Wisconsin. Data from these farmland benchmark properties show a 0-10% increase from January to July of 2025. This is in comparison to all the past year, when these same benchmark properties indicated a change between 0-18%. Location is a major factor in land values, especially in areas of Wisconsin where dairy farms are present, which creates competition amongst buyers. Other factors that influence the value in a particular area is soil type and productivity, topography, drainage, field shape and size, and proximity to urban areas. Looking ahead, expectations point to continued stable values to a slightly increase in values, similar to the first half of the year.

Stable Price Trends so Far in 2025

While farmland values across Illinois, Wisconsin and Minnesota have demonstrated remarkable consistency through the first half of 2025, the story unfolding is one of cautious optimism. The steady pace, modest fluctuations and rebalanced sales activity point to a market that’s resilient – yet acutely aware of broader economic undercurrents. However, beneath this surface of stability lies a complex web of economic forces quietly shaping decisions. To fully understand where land values may head next, it’s critical to examine the influences driving today’s land market behavior.

The Broader Economic Context

The interest rate outlook provides an important backdrop for understanding market dynamics. Persistently higher-than-target inflation, remaining above the Federal Reserve’s target of 2%, combined with a stable unemployment rate of 4.2% has resulted in no changes to the federal funds rate target since 2025 began. The rate has remained at a target of 4.25-4.50% since the Federal Open Market Committee’s (FOMC) December 2024 meeting.

It is possible that the Fed will begin lowering rates again in the second half of 2025, just as it did in 2024. In fact, based on the FOMC’s projections, there is an average expectation of two cuts (the equivalent of 0.5%) before year-end even as the Fed remains cautious of tariff-induced inflation increases. With just three more Fed meetings left this year, there is limited time for monetary policy and interest rates to change significantly. It’s likely rates will remain elevated in the near-term as compared to the 2008-2022 period – although in historical context rates are at moderate levels. The moderately higher interest rate environment may influence some land buying decisions for buyers utilizing financing.

One thing to note, though, is that the Fed can adjust its rates, but the market ultimately sets interest rates experienced by consumers. This supply and demand-driven interest rate market sometimes doesn’t track with what the Fed sets. For instance, longer-term interest rates generally increased during the late 2024 timeframe when the Fed cut the Fed funds rate target four times (the equivalent of 1.0%).

|

There are a multitude of economic factors beyond interest rates that impact cropland prices – from the performance of other investments such as the stock and bond markets to agricultural economic conditions. Grain price fluctuations do not have a strong, real-time, direct relationship with cropland prices; however, they do have indirect influence.

2025 continues to be a challenging year for grain and oilseed prices, and the market is currently trending down based on supply and demand data. USDA estimated 95.2 million acres of corn planted in the U.S. for 2025, up 5.0% from the past year and 83.4 million acres of soybeans planted, down 4.0% from the previous year. This represents the third largest corn acreage in U.S. history. If weather continues to be conducive to good crop growth, farmers will be on track for a large corn crop. In contrast, with soybean acres dropping slightly, the soybean crop is predicted to be smaller.

July’s World Agricultural Supply and Demand Estimates (WASDE) provides more detailed data. The July 2025/26 U.S. corn outlook showed smaller supplies, domestic use and ending stocks. However, with yield projected at 181 bushels per acre and so many corn acres planted, production is projected higher than 2024/25. The forecast season-average farm price for corn received by producers is $4.20 per bushel. The July 2025/26 U.S. soybean outlook showed slightly lower production, higher crush, reduced exports and increased ending stocks compared to last month. The forecast season-average farm price for soybeans received by producers is $10.10 per bushel.

Without surprises from recent USDA reports to drive domestic trade, commodity markets are being driven by the weather for now. Crop conditions are primarily rated good/excellent. In general, nice weather keeps crop prices low/bearish, and bad, very widespread adverse weather would be needed to turn things back higher/bullish. There were certainly pockets of extreme and devasting weather impacts nationwide over the growing season, but they are currently relatively isolated.

In addition to the weather, another unknown that has driven some pricing this year are tariff policies. In general, 2025 agricultural markets have not seen price declines at levels seen during 2018-2020 trade negotiations. One reason for this is agricultural goods traded with our top two trading partners, Mexico and Canada, have been exempt from the 2025 increased tariff rates since March 6. This has led to more stable agricultural markets despite continued uncertainties around trade with other countries.

If previously agreed upon carve-outs for agricultural-related imports and exports, such as the current exemption for goods covered in the United States Mexico Canada Agreement (USMCA), were removed, agricultural commodity marketing prices would likely result in further near-term deterioration.

These trade policy uncertainties could add downward pressure on commodity prices, which, over time, may influence buyer sentiment and land demand.

There are other current fiscal policies affecting economic conditions. For example, several provisions in the recently passed One Big Beautiful Bill Act (OBBBA) relate either directly or indirectly to cropland, from increased commodity reference prices to crop insurance updates to the continuation of tax policies from the 2017 Tax Cuts and Jobs Act that make capital investments advantageous. Since OBBBA will not result in commodity payments changes for reference prices until October 2026, the main factor influencing increased government farm payments in 2025 are from the American Relief Act (ARA). That legislation, passed back in 2024, included nearly $31 billion in ad hoc, or one-time, direct payments to farm producers. Compeer’s appraisal team continues to closely monitor these economic developments to assess how they could shape farmland value trends throughout the year.

Looking Ahead

As we move through the remainder of 2025, the questions to ask may be, will the weather hold? Will all the trade deals get worked out? How will newly passed laws affect investment choices? While land values have remained mostly flat, the underlying indicators point to a market that is cautious but not stagnant – responsive to economic pressures. The rest of summer will be an impactful one for grain and oilseed markets. As we expand the focus from corn and soybean production out to the broader economics of cropland prices, we see a market much more stable than the lower underlying grain prices. Cropland has different supply and demand fundamentals than the crops grown on it. The limited supply of land and continued demand from a variety of buyers – farmers, investors and more – is a strong contrast to the annual growing season production cycles of commodity markets.

At Compeer, we remain committed to tracking cropland trends in real time and providing the insights our clients need to make informed decisions. Whether you're buying, selling or simply assessing your portfolio, understanding the landscape is key – and we're here to help you navigate it with clarity and confidence. Contact Compeer to connect with a trusted expert in farm and rural real estate valuation appraisal services.

Commentary and expertise provided by Compeer Financial’s Diane Zelhart (certified appraiser in Illinois), Carissa Schultz (certified appraiser in Wisconsin), Aaron Stark (senior certified appraiser in Minnesota) and Megan Roberts (ag economist and author of Compeer’s Economic Minute).

Farm & Equipment Appraisal Services

Compeer Financial appraisal services specializes in the appraisal of farms and equipment.

Appraisal Podcast

From land price analysis to value trends, Compeer’s appraisal team provides insight and expertise for all things related to farm real estate in our territory.

.jpg?ext=.jpg)