Looking at ARC and PLC in Relation to Crop Insurance Coverage

With all the unknowns about the 2025 crop year – including an undetermined spring price for crop insurance – it’s difficult to decide between Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC). Making the right choice will allow farmers to invest wisely in protection in this tight environment.

ARC and PLC, administered by the Farm Service Agency (FSA), have been below market levels in recent years, which hasn’t made them attractive safety net options. As prices get closer to their trigger levels, though, these options are more relevant.

|

While ARC and PLC are free products, they most likely will not provide producers with enough standalone coverage. They should be used in conjunction with other crop insurance products.

ARC provides county-based revenue coverage at 86%. It is based on Olympic average yields and prices and used with the marketing year average price and county yields to determine potential revenue losses.

PLC is price loss coverage that insures farmers against a drop in the marketing year average (MYA) price. The average price is calculated from the fall of the current crop year until the following fall using the national average cash price received by producers during that time period. Payments occur if the MYA price falls below the reference price established for that crop year. Payments are finalized on Aug. 31 of the following year.

When electing the supplemental coverage option (SCO) endorsement, producers must choose the PLC option due to its similar coverage to ARC. The biggest difference between ARC and SCO is that ARC pays on a farm’s base acres (85% on ARC-County/PLC and 65% on ARC-Individual), and SCO pays on planted acres for the current year. Knowing your base acres will help you make informed decisions – especially since base acres do not typically align with planted acres.

Here’s how prices are lining up for the 2025 crop year for ARC and PLC, unless there is a new Farm Bill with updated prices:

| Corn | Soybeans |

• ARC - $5.03 (86% = $4.33) • PLC - $4.26 | • ARC - $12.17 (86% = $10.47) • PLC - $9.66 |

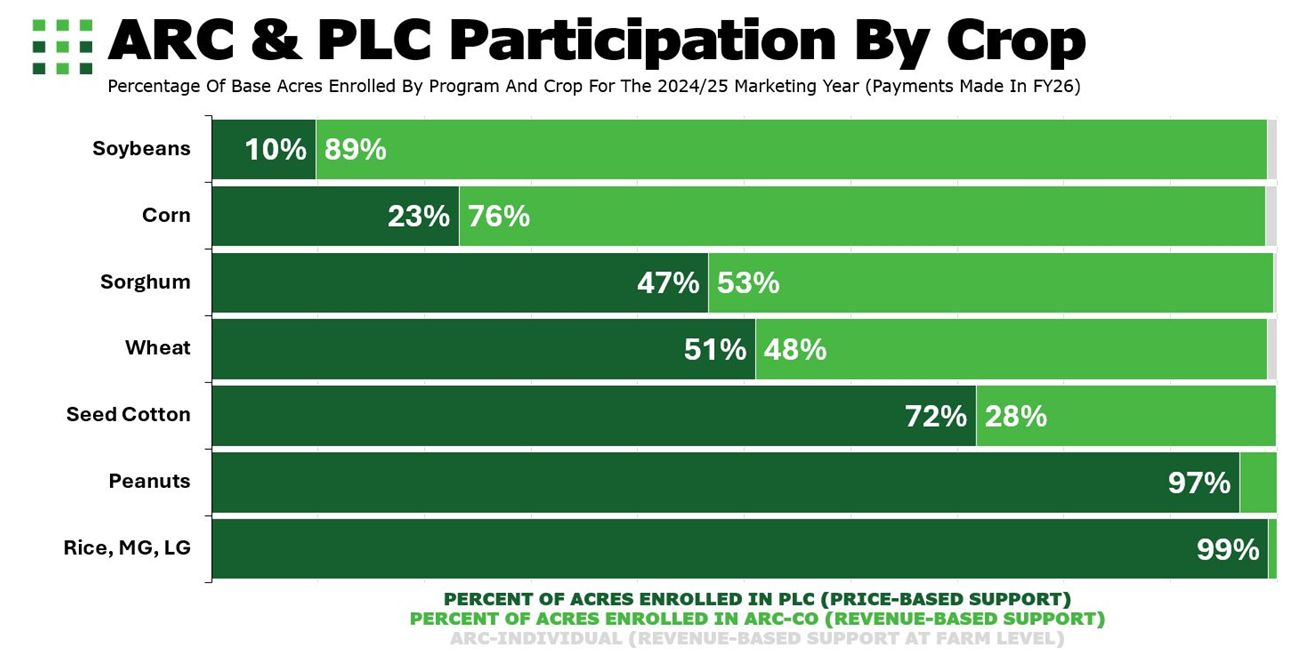

More than 75% of corn and soybean producers have chosen to participate in the ARC program over the PLC program, as seen in the above chart. The higher pricing environment over the past few years influenced this decision thanks to the 2014 Farm Bill’s guaranteed payments. PLC has gained some traction recently with the highly subsidized SCO product that is available when electing PLC.

2025 SCO and ECO

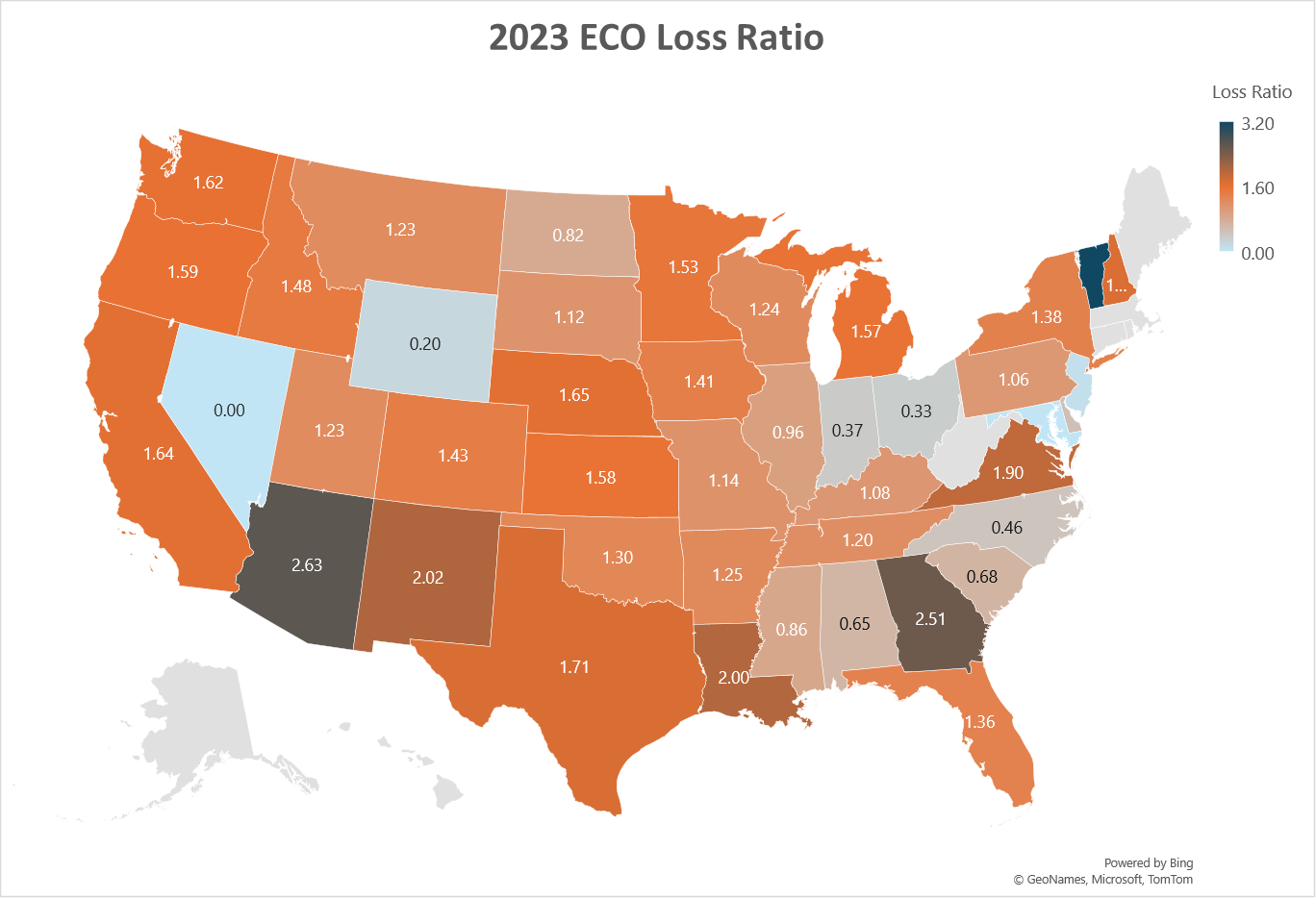

While final 2024 payments for Enhanced Coverage Option claims are still being calculated, 2023 levels were at an all-time high, as seen in the map below that illustrates the loss ratio (ratio of total indemnity payments to total premiums paid).

This history – coupled with the increased federal subsidy on ECO – may make some farmers consider taking ARC at the county level with ECO stacked on top of their underlying policy to save on insurance premiums instead of renewing their SCO endorsement.

This year the subsidy for ECO has increased from 44% to 65%, matching the 65% subsidized SCO coverage. These endorsements, which capture a coverage level up to 95%, are affordable options that can help protect your livelihood and peace of mind.

Election decisions will likely come down to where the spring prices land. If the SCO and ECO price is above the commodity price locked in for ARC, it might be worth taking advantage of the high subsidized endorsements to gain extra coverage.

One thing to consider: The ARC-CO yields don’t always match up with the SCO and ECO yields, which could affect the payment amounts. Insureds would be paid on the 85% of base acres for those farm numbers at the FSA office versus being paid on 100% of planted acres. Double-check base acres before making this decision.

Another major component to consider is the expected county yield. Many of the counties in the Compeer Financial territory have seen an increase of more than 20% since 2018. This means that the move from National Agricultural Statistics Service (NASS) to Risk Management Agency (RMA) production in 2018 was positive, which led to these products having more value. Consult with a Compeer insurance officer or check the actuarials on the RMA website to see how your county fared with the yields provided by RMA.

There is a lot to consider moving into the 2025 crop year. The options presented above can help you capture additional levels of coverage at an affordable rate. Soon we’ll have a better idea of where prices are going to land for SCO and ECO. It’s crucial to compare those prices to ARC and PLC prices. Contact your Compeer insurance officer to help you make the best decisions for your operation.

Understanding the Benefits of Enhanced Cover…

Now is the time to add the Enhanced Coverage Option (ECO) to your crop insurance. Learn about expanded protection and affordability with Compeer Financial.

Crop Insurance

Crop insurance provides farmers with risk management tools to protect against crop loss or the loss of revenue due to declines in crop prices.

Why Now is the Time to Expand Your Crop Insu…

Review ECO historical payout data to help you evaluate your expanded coverage options now that an increase in subsidies made ECO more affordable than ever.