Making Wise Farm Investment Decisions in Your Business

When making an investment, you spend money today with hopes it will generate income in the future. You don’t expect a beef cow to produce six calves and then draw a good price as a cull cow in the first year. You plan to care for her while she produces calves to add to the herd or sell over a number of years before eventually being sold off. Investments take a longer period of time to generate a return. And with that comes risk. For example, your beef cow could become ill and die before ever producing a calf. So how do you know when an investment is wise?

|

The concepts of net present value (NPV) and internal rate of return (IRR) can help us leverage our limited funds available to invest. If you can estimate the investment’s annual cash flow, the number of years you expect to generate the cash flow and the remaining value of your investment (if anything) in a given year in the future, you can calculate the IRR on the investment.

Put it in Practice

You have an opportunity to rent 40 acres of pasture, but it’s in poor shape. You’ll have to spend $8,000 on fencing and other improvements to make it usable. That’s a big investment on land you don’t own; one that will take quite some time to recoup. Can negotiating a five-year lease takes the chance of losing use of the pasture too soon out of the equation?

Let’s estimate how much cash flow you can generate from the pasture each year. You can run 30 steers on the pasture for a 160-day grazing season. They will gain an average of 1.75 pounds day and the value of the gain is $.90 per pound. The gross income from the pasture is expected to be $7,560. The pasture rent, vet expenses, salt and mineral, labor and other expenses will total $3,500. The expected annual net cash flow from the pasture is $4,060.

If you only have the pasture rented for two years, you’ll barely get back the $8,000 you invested in improvements, and you will have worked for nothing for two years. Let’s calculate the IRR on the $8,000 investment if we are able to generate $4,060 of cash flow each year for five years.

You might be tempted to calculate the return by just multiplying $4,060 times five years, and then dividing that total by the initial $8,000 investment. However, this wouldn’t consider the cost of waiting for the cash flow to come in over the course of five years.

Because of inflation, changing market conditions and other factors, money is worth more the sooner it is received. If you received a $4,060 payment today, you could use the money to pay down a loan and stop interest from accruing. You could buy a piece of equipment that would be much more expensive five years from now. You could buy a few beef cows that will produce calves for the next five years. The $4,060 payment that you won’t receive until the year 2025 is worth less than a payment you get today.

How much less is the payment in 2025 worth compared to the payment received today? To answer that question, you have to “discount” that future cash flow to determine its value in today’s dollars (its NPV). To figure out its NPV, you have to decide what discount rate to use and then multiply the $4,060 by discount factors depending on how many years you have to wait for the cash flow.

Review the below table of discount factors at discount rates from 1-20%. How do you pick a discount rate? You could use the same rate as the interest rate you’d pay on a farm loan. You could establish a personal hurdle rate, for example maybe you don’t invest in anything unless you can expect at least a 15% return on your investment. However a person picks a discount rate, it should be adjusted for the riskiness of the investment. The riskier it is, the higher the discount rate.

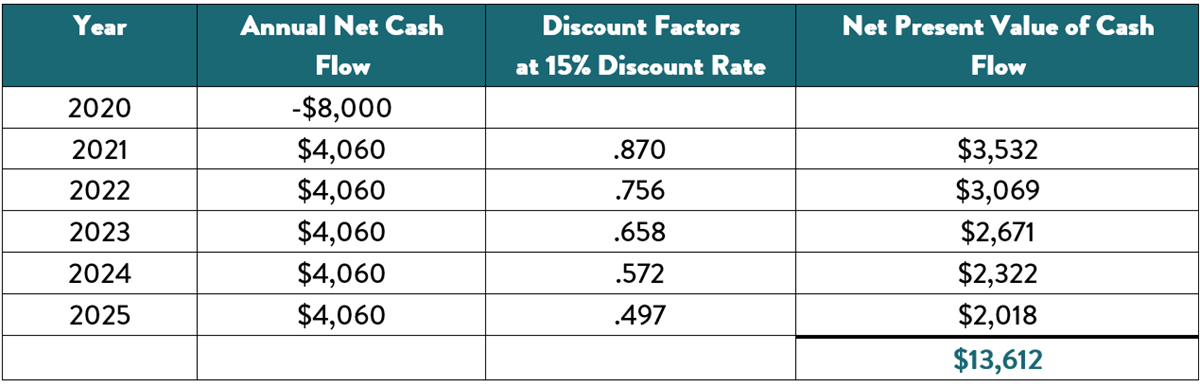

For the pasture analysis, let’s apply a 15% discount rate. You’ll only invest in the pasture improvements if you can achieve an annual rate of return higher than 15%.

When calculating the NPV of each year’s cash flow and then adding them all up, the total is $13,612. Since $13,612 is more than your initial investment of $8,000, it tells you that the rate of return on your investment is better than 15%. If the return on your $8,000 investment was exactly 15%, the total of the NPVs would be $8,000. If the NPV of the whole stream of cash flows was less than $8,000, you’d know that the return was less than 15%.

To calculate the IRR, keep trying different discount rates and applying the corresponding discount factors until the NPV of the cash flows is equal to the initial cash investment. Unfortunately, the table only goes up to a 20% discount rate. When running the calculation through a computer spreadsheet, the IRR on the pasture investment was 41.94%. If you rent the pasture for a sixth year, the IRR increases to 45.37%.

This method of analyzing investments is very common in businesses outside of agriculture, but not widely used in agriculture. It’s a powerful tool. If you only have $8,000 to invest and need to choose between multiple different options, this gives you a logical way to decide which investment is best. It can also help you avoid making an investment mistake such as borrowing money at 5% interest to invest in something that generates a 3% IRR.

If you need help thinking through an investment opportunity, contact your local Compeer financial advisor.

The materials in this article are presented for informational purposes only. Compeer Financial can provide assistance with agricultural finances and operations based on historical data and industry expertise. Compeer does not provide legal advice or certified financial planning. Compeer Financial is an equal opportunity employer and provider, and an equal credit opportunity lender.

Calculators

Take the guesswork out of your financial future with Compeer Financial’s free calculators. Make smarter decisions with Compeer and try them today!

Ag Business Services

Most producers we know would rather sit behind the wheel of a tractor, not behind a desk. Take advantage of our Business Services for easier management of your day-to-day operations.