Successfully Navigate the First-Time Homebuying Journey

The complexity of buying a home, coupled with the pressure that comes with these kinds of big decisions, can leave first-time homebuyers feeling overwhelmed. Designed to make your purchasing journey smoother, more affordable and less daunting, Compeer Financial makes rural living more accessible with our First-Time Homebuyer Program.

Before your dream can become reality, you need to understand the tools available to you and the status of your credit and financials. In a recent webinar, Compeer team members reviewed these steps.

- Evaluate your household income and monthly expenses to figure out what a feasible monthly mortgage payment would be while keeping enough funds back for day-to-day living and savings. Don’t forget to consider how additional costs like homeowner’s insurance and property taxes may impact your budget. And begin saving for closing costs and unexpected expenses now. Our First-Time Homebuyer Program offers a 0% down payment, providing a significant advantage for many first-time buyers who may struggle to save for a large down payment. Additionally, the program does not require private mortgage insurance (PMI), which can add to the monthly cost of a mortgage for first-time buyers.

|

- Understand your credit score and its role in the loan approval process. If your credit score is too low to qualify, begin working to improve it by managing your credit responsibly. Compeer allows for co-signers, which can be beneficial for those who may not quality for a loan on their own. In addition to credit approval, you must be a first-time homebuyer to qualify for our program. This means you have not owned a home in the last three years, including displaced homemakers or single parents who did not have any ownership other than being joint with a spouse during the last three years.

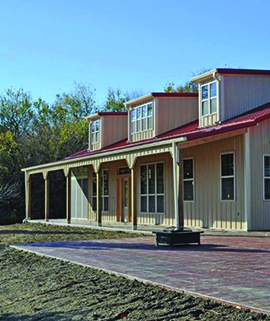

- Consider what type of property will suite your dreams today and tomorrow. Buying a home is a long-term commitment, so make sure you get the most out of your purchase. Compeer can accommodate a variety of unique properties including homes with acreage, hobby farms, small town and manufactured homes, and unique residences like shed homes, cabins, and barndominiums. Our First-Time Homebuyer Program can be used for loan amounts up to $400,000.

- Keep your eye on the local housing market because low inventory and high demand can lead to homes selling quickly and for more than their list price. Working with a realtor can save you time and will make the offer and negotiation phase simpler. Trusted experts in the home buying process make mortgages for first time buyers simpler. Find a Compeer mortgage specialist today, and know patience and preparedness are key in buying a home in the country.

- Review other programs available for first-time home buyers, each with their own set of benefits and limitations. Military servicemembers are eligible for the VA loan program offering as low as zero percent down. FHA loans start around 3.5% down, but have acreage limitations. Conventional loans from a banking institution start at 3% down and requires private mortgage insurance (PMI) if you have less than 20% down payment. In addition to Compeer’s zero percent down payment mortgage option, you are eligible for patronage dividends and servicing options such as rate conversions.

- Make a plan for loan payments to avoid late fees and potential credit impacts. While there are several options available, such as mailing in a payment or using online bill pay services, the most efficient and reliable method is setting up an Automated Clearing House (ACH) payment.

Compeer’s First-Time Homebuyer Program helps more people achieve homeownership and invigorates rural communities in the process. To learn more about the program and how to prepare for the homeownership journey, view the full webinar hosted by Compeer team members or take our short First-Time Homebuyers online course.