Which Crop Insurance Endorsement is Right for Your Operation?

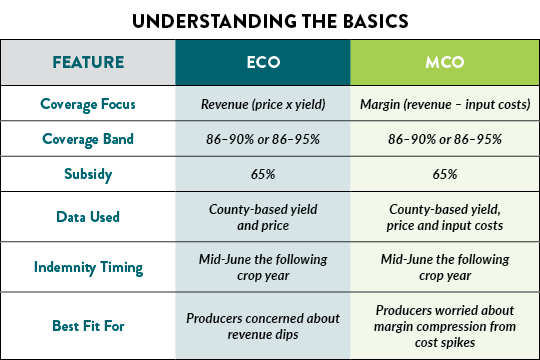

When it comes to protecting your farm, there’s no one-size-fits-all solution. That’s why Compeer Financial offers multiple coverage options designed to fit the unique risks faced by today’s producers. Two powerful tools – the Enhanced Coverage Option (ECO) and the new Margin Coverage Option (MCO) – provide additional protection beyond your base policy.

But how do you choose the right one? Let’s break down the differences and explore how Compeer’s team can help you make a confident, informed decision.

|

Key Differences: Revenue vs. Margin

ECO is ideal if you want to strengthen your coverage against yield or price declines in your county. It kicks in when county revenue drops beyond your elected deductible –even if your own operation is doing well.

MCO, on the other hand, adds protection by allowing another price discovery while also covering when input costs like fertilizer, diesel or natural gas rise. If your yields hold steady but margins are tight due to climbing expenses, MCO can provide support when Revenue Protection (RP) alone would not.

Real-World Scenarios: Choosing the Right Fit

- ECO might be the right fit if…

You’re seeking simplicity for shallow loss coverage, focused on maximizing revenue protection while not factoring in input price movement. This option follows your MPCI base policy prices. - MCO might be the right fit if…

You’re buying protection for inputs that are not locked in and want to lock in a cost floor in the fall with concern about rising input costs. This is also a way to capture an additional pricing window if spring crop prices rise in the fall of the prior year. - Both provide low-deductible coverage options and build a broader safety net across revenue and margin risks. MCO and ECO provide impactful options to consider as you build the most optimal coverage for your operation.

Compeer Financial: More Than Just an Insurance Provider

We’re here to guide you, not just sell a policy. Our insurance officers partner with you to build a customized risk management strategy that fits your goals, your fields and your future.

If you’re unsure which coverage is right for you – or how they could work together – let’s talk. We’ll walk through your priorities, run tailored options and help you understand exactly how these products can support your bottom line.

Crop Insurance

Crop insurance provides farmers with risk management tools to protect against crop loss or the loss of revenue due to declines in crop prices.

Understanding the Benefits of Enhanced Cover…

Now is the time to add the Enhanced Coverage Option (ECO) to your crop insurance. Learn about expanded protection and affordability with Compeer Financial.

Margin Coverage Option (MCO) Protects Farm P…

Explore how MCO protects your profit margins with coverage for rising input costs and shallow losses—an area-based solution built for today’s farm challenges.