Land Values Accelerate across West-Central Illinois

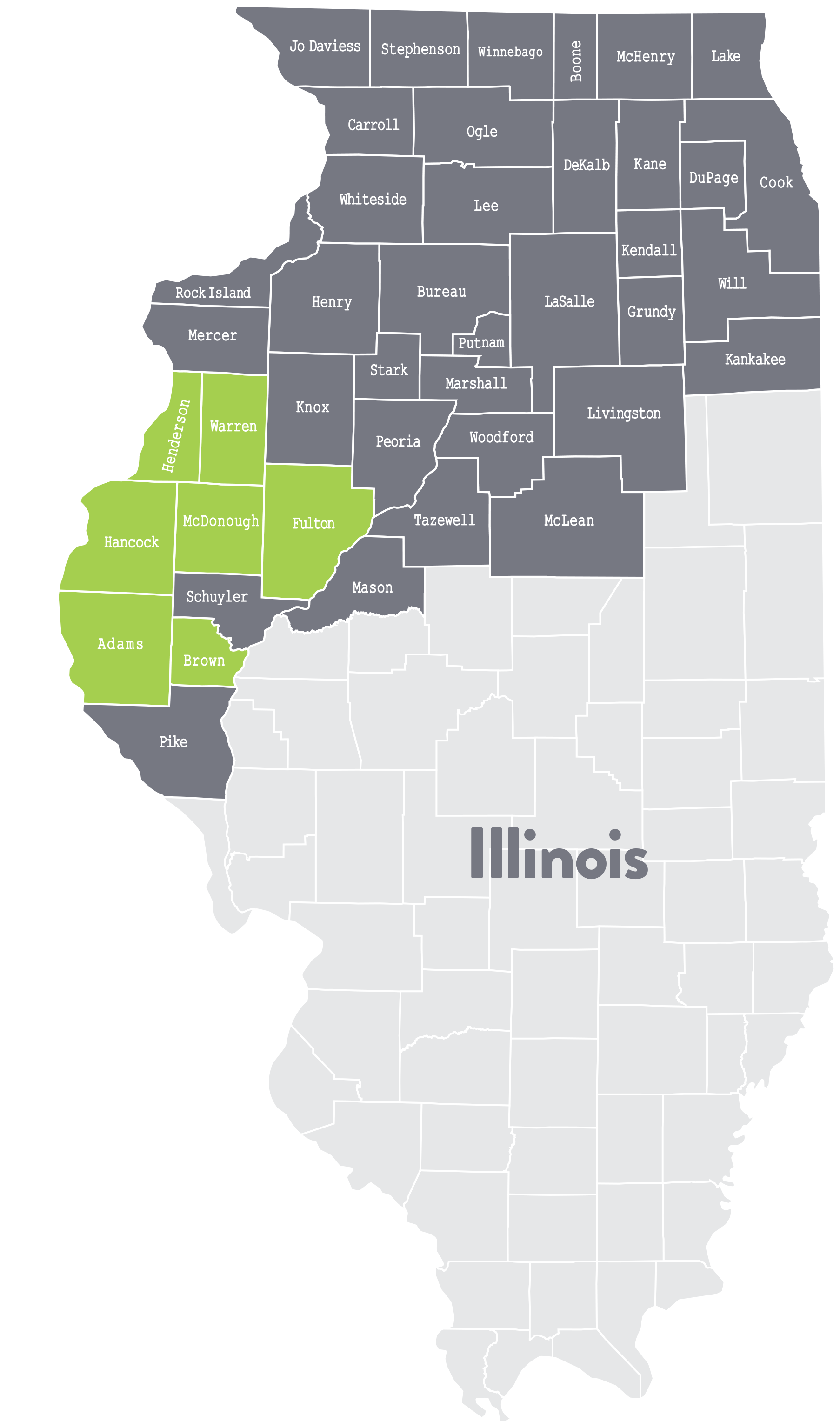

The most common questions I get as a farm real estate appraiser are “What are land values doing?” and “Where are land values heading?” Answering these questions in a concise manner is incredibly challenging as West-Central Illinois is highly diverse. This region, as highlighted on the map below (Adams, Brown, Fulton, Hancock, Henderson, McDonough and Warren counties) has some areas with the most productive soils in the state while other areas are characterized by rolling topography and lower producing soils. There are also pockets of world-renowned recreational land mixed intermittently throughout.

Getting back to the original question, the answer is actually very simple. Values are going up. That’s easy to see with nearly all land classes in this territory seeing double digit increases over the prior year (on a percentage basis). To better understand what is going on, we need to look at who is buying the land right now, and identify their motivation.

Although there is a high degree of variability, right now farmers or retired farmers are the predominate buyer of farm real-estate. There are a few investors in the market looking for land, but in this area, they typically already have a relationship with a tenant and are having the tenant identify land for future acquisition.

Various geographic areas in this territory typically have different attitudes toward buying farmland which makes appraising these areas challenging. In certain areas, where there are multiple well-established farming families, the sky becomes the limit on values. In other areas similar or even more productive land will sell for significantly less as farmers are more content with what they own and are willing to expand through renting ground. These operations have historically purchased land that they have rented for less than other areas, keeping values lower. When farmers are the primary farmland buyers this makes painting values with a wide brushstroke very difficult.

High | Low | Avg | Increase since July 2020 | |

Cropland A (PI 133-147) | $16,700 | $9,500 | $11,772 | 15% |

Cropland B (PI 117-132) | $13,000 | $7,100 | $8,999 | 10-15% |

Cropland C (PI 100-116) | $10,902 | $3,500 | $5,847 | 10% |

Cropland D (PI less than 100) | $5,100 | $3,850 | $4,679 | 2-5% |

Pasture | $6,128 | $2,900 | $3,968 | stable |

Recreational | $4,972 | $2,799 | $3,938 | 5% |

What conditions are driving land values? At the present time, grain prices seem to be driving land values. With corn during the first half of 2021 being in the $5-$6 per bushel range for new crop and even higher for old crop, farmers are projecting to make significant profits in 2021 assuming they produce an average crop. Here in West-Central Illinois, we had a wet month of May which delayed crop progress. However, many farmers forecast that there will be at least trendline yields with much higher prices than in recent history. From a historical perspective, this crop year’s input costs have been very affordable as most prices were based on the 2020 crop year which was characterized by low commodity prices. Higher grain prices for the end of the unpriced 2020 bushels, higher expected revenue for 2021 due to higher prices combined with historically low interest rates create an ideal environment for stronger land values. Below are some of the most recent farm sales in the territory.

Recent Farmland Sales

Date | County | Acres | Price / Acre | Avg PI | $ / PI |

21-Jun | Hancock | 135 | $11,900 | 134 | $95.41 |

21-Jun | Hancock | 134 | $16,700 | 139 | $122.19 |

21-Jun | Fulton | 138 | $10,500 | 131 | $85.59 |

21-Jun | Pike | 37 | $16,000 | 119 | $136.95 |

21-May | Hancock | 60 | $7,100 | 114 | $67.19 |

Recreational land values have also been increasing with most recreational properties selling quickly. As it stands, demand is greater than supply. There are many different recreational buyers, with the sales at the top of the range usually being high-end buyers with transactions well over a million dollars for hunting land. There has also recently been strong demand for smaller tracts by local blue-collar workers.

Where are land values heading? I don’t have a crystal ball, but looking at projections of net farm income for the fall of 2021, I would expect land values to continue to strengthen throughout the rest of the year. Forecasting beyond this, many variables must be considered. Assuming a good crop and prices remaining strong going into 2022 I would expect the extra cash sitting around to be put into farmland. However, crop input prices are expected to increase, which is already being reflected in fertilizer and chemical prices. As the broader economy begins showing signs of inflation, which will cause interest rates to increase. There will likely also be pressure to increase cash rent into 2022. With all of these issues on the horizon, I would expect land values to stabilize into 2022, but if commodity prices continue to increase I think land values will follow.