Estate Planning: The Impact of Rising Land Values

“Before anything else, preparation is the key to success.” – Alexander Graham Bell

When it comes to growing and harvesting crops, farmers are excellent planners. Examples are plentiful – from which seed varieties and populations to plant to deciding the right fertilizer application rates post-harvest. These entrepreneurs are also highly strategic as they contemplate machinery purchases, grain sales and acreage expansion. Unfortunately, it is all too common for these operators to have such a fixed concentration on their operation’s daily and seasonal demands that they can lose sight of the looming future consequences of their farm business’s growth. While it is imperative that a farm business owner identify a future successor, there is equal long-term risk to an operation’s viability by lacking an effective estate plan.

To clarify, there are distinct differences between succession planning and estate planning. Succession planning is the process of identifying the critical leadership positions within the farm operation and developing individuals to assume these roles. Estate planning, by contrast, is the process of planning for and arranging the transfer of those farm assets during that person’s life.

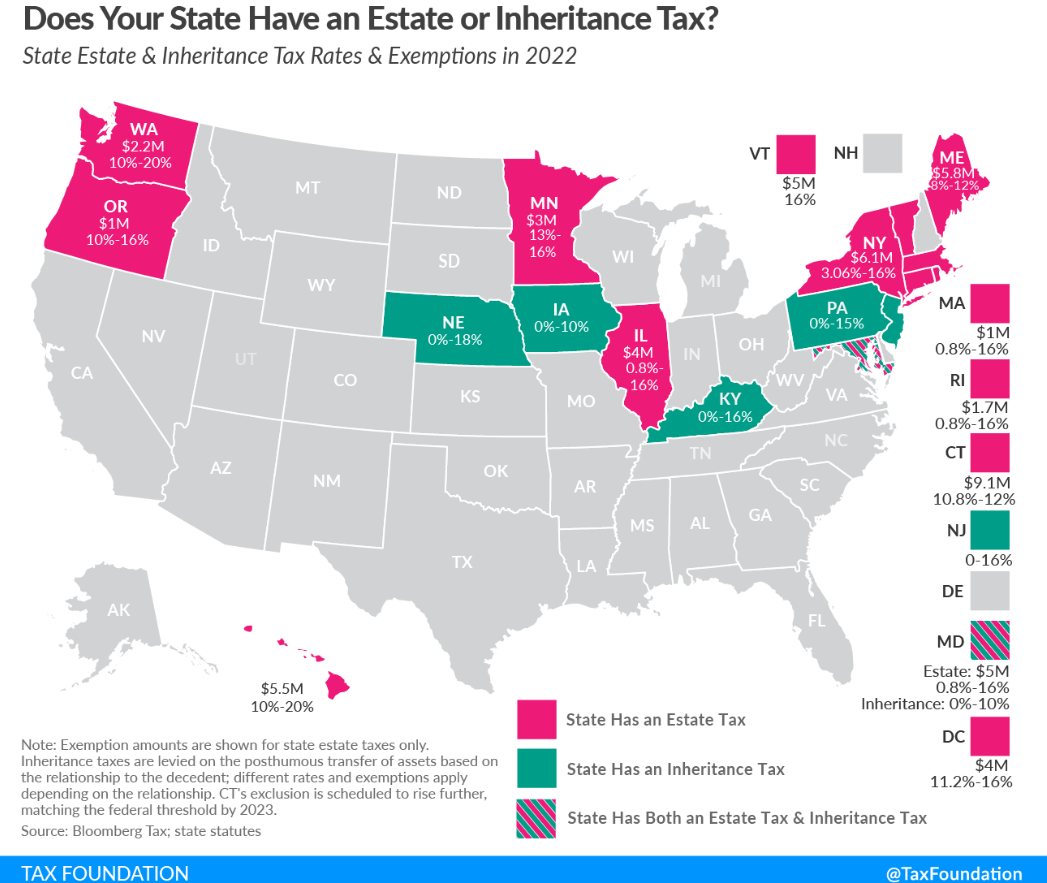

“Estate taxes are paid by the decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate,” says Janelle Fritts, policy analyst with the Tax Foundation. “In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional state estate tax or state inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes.” Illinois has a state estate exemption level of $4 million in 2022, meaning an estate’s asset value above this threshold would be subject to the state’s graduated estate tax rate.

To help put this information into context, the below-chart depicts the year-over-year change in Compeer Financial’s “Class A” Illinois farm benchmark values. The average value of these farms in December of 2022 was $17,207 which represents an increase of 18.90% from the prior year. The consequences of these rapidly increasing and historically high land values to farm businesses are far-reaching. Take for example a landowner with 240 acres of excellent-quality farmland. Assuming no debt, this estate would likely be subject to the state estate tax with a total value of $4,129,714.29. If the property were located in Knox or Warren County, with an average county value of $20,000 per acre, the estate would only need 200 acres to reach the $4 million threshold.

By running various scenarios of price and acreage, the $4 million threshold can be rapidly surpassed, especially when including other assets like machinery and other investments. There are multiple strategies for limiting estate taxes, including marital transfers, charitable/family gifting, and/or establishing a trust or family limited partnership (FLP). Upon execution of any one of these strategies, we recommend documenting assets the time of transfer by way of a real estate appraisal.

The appraiser is one in a long list of key advisers that can offer perspective to help achieve a business owner’s objectives. Much in the same way that the accountant, lender, financial planner and attorney offers their technical expertise to help in decision-making, the appraiser’s role is to provide an objective, accurate opinion of the real estate and equipment necessary to substantiate asset values and ensure a sound estate plan.

The quote at the beginning of this article was told by one of history’s best-known inventors. Although his telephone debuted nearly 150 years ago, the concept of preparedness has not diminished over time. Whether a business owner wants to see their business continue for generations or shield heirs from future tax liability, business preservation starts with an estate plan.

The Appraisal Department at Compeer Financial can serve one part in this planning process and help clients achieve their long-term goals. Check out our other appraisal resources and find your local appraiser.